Last year, I signed up for a wonderfully ambitious initiative spearheaded by our Governor General, His Excellency David Johnston. I was invited to join a Group of Seven who will serve as catalysts to rolling out David Johnson’s vision of a Smart and Caring Nation built by a set of Smart and Caring Communities, ultimately aimed to be a major national initiative to commemorate Canada’s 150th birthday, or sesquicentennial, in 2017.

I was very much honoured to be asked and, although it is a dauntingly large not to mention a somewhat unspecified, goal, as a proud Canadian who knows first hand David Johnston’s unique ability to lead and motivate, I quickly agreed to this call. I’ll share more about this initiative in order to seek your input. Since no small group can be representative of our huge and diverse nation, it is important the we engage in much dialogue from Canadians of all ages and demographic profile, in order to achieve maximum impact and relevance.

As a way to start that conversation, I’d like to share some of my perspectives on Smart and Caring 2017.

David Johnston’s Smart and Caring Vision:

This whole project starts with a great foundation in our Governor General’s Smart and Caring vision for Canada. And here is why his singular leadership is so critical to this initiative.

David Johnston has a long track record of motivation. Back in 2006, as President of Unviersity of Waterloo, he challenged the already ambitious and successful business, community and government leaders in Waterloo Region to reach even higher. Issued in November 2006, his Ten Goals to Make Waterloo Region Canada’s Knowledge Capital are a blueprint that inspired and motivated real change and continue to have an impact today.

Similarly, on 1 October 2010 at his installation speech as Governor General in the Senate Chambers in Ottawa, David Johnston laid out his vision for nation building in Canada, challenging us to build a Smart and Caring Nation:

“We are a Smart and Caring Nation.

A nation where all Canadians can grow their talents to the maximum.

A nation where all Canadians can succeed and contribute.

But there is much work to be done to fully achieve our vision of a Smart and Caring Nation. I believe it is essentialTo support families and children,

To reinforce learning and innovation, and

To encourage philanthropy and volunteerism.”

To build on that vision as we near the sesquicentennial of Canada as a country in 2017, His Excellency has challenged Community Foundations of Canada and the growing network of 191 grass roots Community Foundations across our country. He wants them to lead a groundswell movement, in each and every community and nationally, for Smart and Caring 2017.

Canada – A History of Evolutionary Nation Building:

With that vision as inspiration, and as a passionately proud Canadian, here is my perspective on Canada as a nation. We were not formed by revolution, as is the case in many other countries like the USA or France. True to our character, our particular style of nation-hood opted instead for evolution at a slow almost glacial pace. You might almost say that Canada pioneered nation building by committee. Specifically, a series of meetings commencing with the Charlottetown Conference, 150 years ago in 1864, led to Confederation on 1 July 1867.

I would argue that, as a nation, we were more defined by what we were not — ie. no tea parties or revolutions to overthrow a king. Instead, via peaceful change we enjoyed a tabula rasa upon which to architect a unique nation in those lands north of the growing United States of America. The process was slow. We remained essentially a colony with large parts of the country feeling more British than Canadian for many years. Consider how long it took us to have a non-British Governor General (Vincent Massey, 1952), our own flag (1965, replacing the Union Jack) or our own constitution (repatriated from Westminster in 1982).

Until the late 20th century, innumerable British colonial vestiges remained. Many people argue that Canadian heroism and sacrifices for the motherland in World War I, just 100 years ago, started the modern trend of a strengthening Canadian identity both internally and as a nation on the global stage.

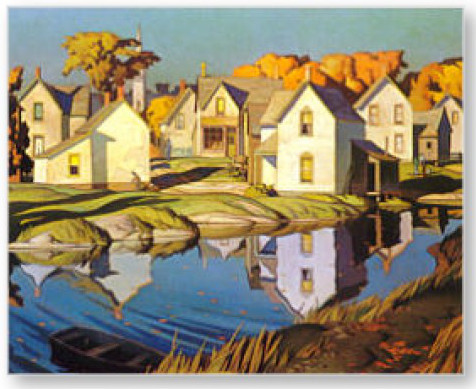

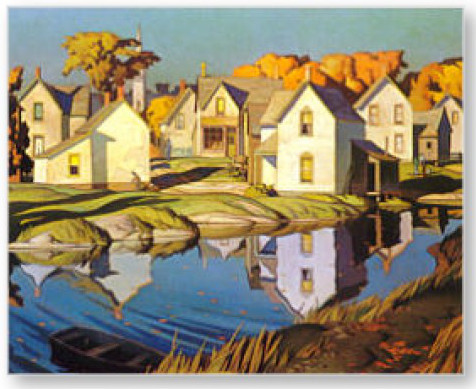

Shortly after WWI, an influential group of painters, the original Group of Seven artists, created a truly Canadian vision of our country through direct contact with nature and our awe-inspiring landscape. Their work was notably distinct from the prevailing British styles of Turner, Constable and later British or European artistic styles.

Shortly after WWI, an influential group of painters, the original Group of Seven artists, created a truly Canadian vision of our country through direct contact with nature and our awe-inspiring landscape. Their work was notably distinct from the prevailing British styles of Turner, Constable and later British or European artistic styles.

Canada’s Centennial in 1967 marked a major inflection point for Canada. We had come through two world wars with a strong sense of national identity, supported by the burgeoning post war economy. Canada proudly led on the world stage with the likes UN Peacekeeping, Expo ’67 in Montréal and the uber cool federalist Prime Minister Pierre Elliot Trudeau.

Set right in the middle of the swinging 1960’s, our centennial celebrations in 1967 were a wonderful time to be alive. Besides Expo ’67 and the quaint historical “centennial” costumes people wore, today we are left with innumerable Centennial arenas, parkways, libraries, etc. These major investments in infrastructure are present with us today. I recall that time with pride and fondness.

CFC Smart and Caring Project:

Because the 21st Century seems so different than the previous, what kind of movement should honour Canada’s 150th birthday. It is a complex question, but I believe that if we can mobilize almost all communities across Canada into activities and projects inspired by the “Smart and Caring” mantra, like a national pot luck dinner we would effectively crowdsource some of national, and even, international significance.

Once again, we have a unique opportunity to make positive changes while setting a positive example for the world.

It is important to understand that, because each and every community is unique, communities must have the freedom to launch initiatives that directly suits their unique needs. Nonetheless, with diverse initiatives considered collectively, I believe that, taken as a whole we can shape and inspire the Canada of the future. We have so many advantages and the time is right to embark of nation building for the 21st century.

I would further hope that we would see collective action and partnership, both at the community level and national level, to increase the impact and effectiveness of the Smart and Caring 2017 initiatives. We must speak to and be meaningful to all Canadians:

- young and old

- recent immigrants or multi-generational Canadians

- from east to west to the most northern reaches

- Aboriginal, English, French or any other heritage

Because no group, no matter how large, can be sufficiently inclusive, that is why it is absolutely imperative that we, who have been honoured to help make this happen, hear from as many Canadians as possible.

Please weigh in here with comments or find other ways to get involved. And, I hope to provide more updates and opportunities to engage, participate, shape and drive Canada’s 150th birthday celebrations – Smart and Caring 2017.Please start by sharing your thoughts on what Smart and Caring 2017 means to you.

In our 3rd year, some exciting changes are afoot as we see our vision for the Prize unfold.

In our 3rd year, some exciting changes are afoot as we see our vision for the Prize unfold. To accompany the design, Chris selected the recently designed LL Circular font by Laurenz Brunner from Lineto in Switzerland. The font manages to be “geometric without being cold” and timeless while modern.

To accompany the design, Chris selected the recently designed LL Circular font by Laurenz Brunner from Lineto in Switzerland. The font manages to be “geometric without being cold” and timeless while modern.

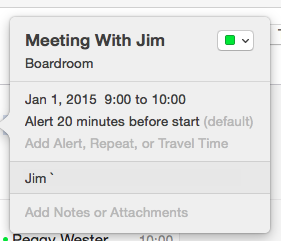

rd party inviting me to a meeting could embed their own meeting information in my calendar, and yet I am unable to edit this “foreign” request that has invaded my calendar.

rd party inviting me to a meeting could embed their own meeting information in my calendar, and yet I am unable to edit this “foreign” request that has invaded my calendar.

Shortly after WWI, an influential group of painters, the original

Shortly after WWI, an influential group of painters, the original

A GO Train is stranded on flooded tracks in Toronto on Monday, July 8, 2013. THE CANADIAN PRESS/

A GO Train is stranded on flooded tracks in Toronto on Monday, July 8, 2013. THE CANADIAN PRESS/

Mobile user experience has, as it were, come up from the Farm and we are now definitely in Paree. It’s hard to imagine how things could get much better, yet an even more exciting future in mobile will undoubtedly unfold. The pace of change has been almost mind boggling, with Android appearing to move almost twice as fast as iOS, the more proprietary Apple platform running iPhone and iPad.

Mobile user experience has, as it were, come up from the Farm and we are now definitely in Paree. It’s hard to imagine how things could get much better, yet an even more exciting future in mobile will undoubtedly unfold. The pace of change has been almost mind boggling, with Android appearing to move almost twice as fast as iOS, the more proprietary Apple platform running iPhone and iPad.

Pitching in Istanbul

Pitching in Istanbul

18 Sep 2016

0 CommentsWho Will Lead Our Institutions’ Response to Climate Change

Even though a life-long environmentalist, looking at the world through my children’s eyes drives home how pressing, and enormous, is the card we have dealt them. That legacy of unprecedented global climate change, leaves little choice between measures to achieve a rapid reversal of climate change or living with global apocalypse.

Personally, I vote for reversal, as one expects would most rational people. However, getting there requires a complete re-think of our lives, and our communities. In my daily life, I see huge opportunities.

Having grown up in Listowel, Ontario, I recently attended the closing ceremony for the Central Public School which will be replaced by North Perth Westfield Elementary School – the difference in the names, previously “Central” to the new “West field” says it all and is illustrated in this map.

Although we all spent time reminiscing about memories and a proud history comprising at least 3 school buildings on the “Central” site, the issue I raise isn’t about heritage. The new school will necessitate a school bus ride for essentially all students. Unlike Central, where most students walked or biked to school, that option will be closed to all but a handful.

Beyond contributing to our climate change crisis, childhood obesity has doubled in the last 30 years (Reference: Centers for Disease Control), mostly as a result of less healthy eating and lack of physical activity. In an age where Physical Literacy and promoting active lifestyles has moved to the top of our agenda, school location should be seen as a contributor to the solution instead of being a major part of the culprit.

Near Elora, Centre Wellington District High School went through a similar “de-centralizing” exercise a few years ago. Groves Memorial Community Hospital is slated to move from its central location near downtown Fergus to a “green field” site (note the prevalence of the word “field” in these decisions) in land between the built up areas of Fergus and Elora. It is notable that the founder of Groves, none other than Abraham Groves was a social innovator of the previous century, who as a doctor pioneering surgical sterilization, did the first successful appendectomy in North America, created hydro power and phone service all to drive change in his home community. I am sure that if Groves were alive today, he would be promoting walkability and carbon footprint reduction.

Urban cores, and small town downtowns, continue to struggle with the appearance of big box stores on the periphery of communities. In addition to often devastating effect on once vibrant centres of community activity, this trend further exacerbates more driving and less walking. Not a good combination.

How do these choices in pubic infrastructure relate to the apocalyptic images of destruction at the top of this post? Climate change is very real with the effects more and more visible, and traumatic as each year passes. Events like the recent Fort McMurray fire, Goderich Tornado in 2011 and severe flooding in the UK can all be traced to the dramatic changes in global climate unfolding over the last few years. The steady, yet gradual increase in the earth’s temperature, leads to greater volatility and severity of weather events. We all know the depressing reality that, horrible as these are, things are going to get worse before they get better.

We used to call the buildup in Greenhouse Gas (GHG) emissions, driven by human activity powered by a reliance on fossil fuels such as oil and coal, Global Warming. It has been rebranded as climate change to reflect the reality that, although the average temperature increases, the main effect is to increase weather volatility. This volatility translates into extreme climate-related events with increasing frequency. Globally, climate change may lead to famines, mass migrations and wars of unprecedented scale and attendant misery.

Faced with this stark reality, you would expect a universal call for governments and public institutions to provide leadership to address climate change?

You would think not, but recent experiences have been been vividly frustrating in showing that, in fact, our public institutions have a long way to go. How are we, as citizens, able to do our part in these circumstances?

First it helps to break down such a massive problem into its constituent parts. To start, let’s quantify the effect that our transportation has on GHG reduction. From data compiled, ironically, by the Canadian Association of Petroleum Producers, transportation is the biggest single sector contributing to Greenhouse Gas emissions, closely followed by Oil and Natural Gas producing industries. Further, Canada has a much poorer record in this regard than other rich nations.

We live in an era when people care deeply about the well-being of future generations. Residential homebuyers are increasingly prioritizing Walkability Scores, which include access to nearby schools in home buying decisions. No generation is more concerned than the Millenials, who have internalized the legacy that climate change will seriously and adversely impact them during their lifetimes. A major way to reverse GHG emissions growth is to tackle personal transportation – to work, schools, hospitals, leisure and shopping.

Collectively, the “M.U.S.H. Sector” (publicly funded organizations like Municipalities, Universities, Schools and Hospitals) has a huge opportunity to take leadership in our current war on carbon. While we might believe that leadership must start at the top with government, without grassroots calls for change the political cost can be too high. (See: CBC News: Politicians Are Green Until They’re Intimidated by the Electoral Price) The challenge will be to empower ordinary folk to drive a climate positive future by taking such thinking from the realm of environmentalists and making it mainstream.

We urgently need an optimistic call to action that citizens can easily embrace. I am working with people that the Elora Environment Centre, an NGO leading innovation and action on the environment, to repackage the Climate Change narrative from one that leaves people powerless, frustrated and even guilt-ridden. We aim to find ways to re-boot the climate change narrative, and unleash a crowdsourced solution coming from the grass roots. Stay tuned. Our planet and our children are counting on it!