15 Mar 2009

0 CommentsWho Killed Canadian Venture Capital? A Peculiarly Canadian Implosion

“Fortes fortuna adiuvat” – “Fortune favours the bold” – Latin proverb

The current economic meltdown has unleashed brutal forces acting on all aspects of the business world, but certainly innovative startups in fields like software, web, wireless, green technologies and life sciences are at grave risk. In Canada, our startups have generally been world class innovators, but severely underfunded when benchmarked against US and leading European countries.

Not only has the credit crunch forced most Angel Investors to the sidelines, but the supply of Venture Capital (VC) in Canada has contracted almost to the vanishing point.

Tomorrow’s Canadian Business documents this very well in VC Financing: Cold Realities.

Having started my first software company in the mid-1980’s, I am well aware that although VC money was available and well established in the Silicon Valley, VC money for knowledge-based startups such as mine was then nonexistent in Canada. Through the 1990’s, however, Canada started to build a cadre of new funds that showed early promise of replicating a US style VC funding ecosystem

In the early millennium when Verdexus investigated raising a institutional fund to fill a gap in the Canadian market with our “hands on” model and accessing global capital sources. It gave our partners a chance to look to VC best practices on a global basis and figure out how to apply to the Canadian context. While we didn’t proceed at that time, I’ve had the good fortune to work on projects with top VCs from the US and several European countries, giving me a global perspective on how Canadian Venture Capital measures up.

Sadly, I believe that the 2000/2001 tech bubble, or dot com meltdown, stopped the maturation of our VC industry in its tracks, a body blow from which the industry has never recovered. It is to this time that the root causes of our current VC meltdown can be traced. A few of the main reasons holding the VC industry back can be summarized as follows:

- Impact of the Labour Sponsored Investment Fund model on our VC ecosystem.

- Lack of balance between financial and operational skills: The Banker Effect.

- Lack of International Funding discipline in our VC industry.

I will explore each of these causes in turn.

1. Labour Sponsored Investment Funds

Labour Sponsored Investment Funds (LSIFs, also known as Retail Venture Capital Funds), have been a particular sore spot, as a 2005 Globe and Mail Report on Business article “Labour-sponsored Love Lost” points out. Considered good public policy when launched in the late 1980’s, both Federal and Provincial governments gave individual (retail) investors a significant tax incentive (up to 35%) to invest up to $5 000 with a minimum 8 year hold period. In essence, many funds totalling hundreds of millions of dollars were raised by firms like VenGrowth, Covington and Growthworks as were numerous very small funds.

Lacking the inherent financial discipline imposed by typical venture capital structures, in which several “funds of funds” (legally dsignated as Limited Partners, or LPs) invest in a fund managed by a General Partner (or GP). The LPs in this sense have much leverage, not just in choosing their GPs, but also in ongoing oversight, not to mention the choice to re-invest in the next fund raised by the GPs. This LP/GP structure is the model employed world wide and has generally stood the test of time.

The thousands and thousands of retail investors in a typical LSIF exert no such control and hence we’ve seen Management Expense Ratios (MERs) as high as 4-6% versus the 2% private equity industry norm and Carried Interest (the portion of the investment gains shared by the fund) as high as 30% versus the 20% norm.

More importantly, although at its peak, more than half of Canadian VC money was in LSIF funds, returns were, as Doug Steiner says, “lousy.” How lousy? Studies show that average fund returns, also called Internal Rate of Return (IRR), are negative. The best fund appears to have produced a measly 1% IRR. In the US, funds aim for 30% and there is a long term track record of many funds in the 18-20% range.

Undoubtedly, individual investors didn’t have a lot at stake with those huge tax credits and it can be argued that LSIFs encouraged loads of job creation in the all important knowledge economy. All of that is true. My main concern is that the attraction of the LSIF model impaired the formation of a more mature VC ecosystem based on the normal LP/GP model mentioned above.

2. The Banker Effect

Credit: AIAlex.com

Credit: AIAlex.com

In the US, both in California’s Silicon Valley and in the Route 128 area around Boston, the VC industry has always been populated by a healthy mix of the financially oriented fund managers coupled with serial entrepreneurs who have founded and build technology startups. The composition of the partners at Canadian VC funds has always been different than this international norm, having many more banker types than operators. The experiences Jonathan Geist relates in the Canadian Business article are symptomatic of this difference. Too much focus on the numbers is like looking in the rear view mirror when startups need to be focused on the future – building market share, refining partnerships and developing strong go-to-market execution.

Again, I believe that this gap can be attributed to us being a less mature VC and startup ecosystem. In the late 1980’s and 1990’s finding seasoned technology startup operators would have been almost impossible. Most were still building their first startup. However, had things unfolded as they should have, many of the startup founders from the 1980’s and 1990’s should now be partners at Canadian VC firms. That didn’t happen because the dot com meltdown appeared to remove the ability to the industry to make changes or take risks. Ironically, this exacerbated an already more conservative VC culture here in Canada, and this more risk averse approach actually contributed to the lower IRRs seen when Canadian VCs are compared to their US or European peers.

3. Lack of International Money

The fledgling LP/GP VC industry of the 1990’s was funded by a relatively small ecosystem of LPs, such as OMERs, Caisse de Depot, Teachers, CPP, BDC, etc. Thus every VC fund was essentially not differentiated by its LP composition. In essence, a closed group of Canadian fund of funds all were chasing this same relatively small asset class. Furthermore, the relaxation of Canadian content rules coupled with these aforementioned low IRRs, sent the Canadian LPs looking elsewhere (mostly abroad).

What is the right recipe to change this situation? Quite simply, access to more global sources of money. The thousands of US, European and Gulf institutional fund of funds investors have largely ignored investments in Canadian VC funds. This is partially because of the chicken and egg of lower IRR returns. But, more fundamentally, it is primarily because the Canadian startup and VC ecosystem had low visibility to these international funds. Several years ago, I spoke to a large €6 billion LP fund at EVCA in Barcelona, that had investments in 40 tier 1 VC firms in each of the US and Europe. Ironically, that LP’s sense of the Canadian technology scene was limted to Nortel. Since Nortel hasn’t really been a star for many years. Clearly we have a long way to go market our great technology stories to the world.

The Way Forward

Unlike this sign, I don’t want to end this piece on a note of doom and gloom. Nor do I want to leave the impression that there aren’t very talented people in the Canadian VC industry. Nothing could be further from the truth – our long term VC gap arises from long term structural challenges, such as a lack of discipline as imposed by global LPs and not having reached the proper banker/operator mix. There are other factors, including the small population and large geography unique to Canada, but all can be and should be overcome with the proper model.

Unlike this sign, I don’t want to end this piece on a note of doom and gloom. Nor do I want to leave the impression that there aren’t very talented people in the Canadian VC industry. Nothing could be further from the truth – our long term VC gap arises from long term structural challenges, such as a lack of discipline as imposed by global LPs and not having reached the proper banker/operator mix. There are other factors, including the small population and large geography unique to Canada, but all can be and should be overcome with the proper model.

We already have a few outliers in our funding ecosystem. Being optimistic and entrepreneurial, I’m convinced that many talented individuals will find ways to, little by little, to invent and rebuild a healthy network of startup financing alternatives. As I’ve argued in other blog posts, there is a role for governments. However, that role isn’t to pick winners or to enter the VC business directly, rather it is to be a catalyst to the process by streamlining (securities) regulation and taxation.

As a stakeholder in the success of knowledge-based startups, what do you think?

Please share your comments.

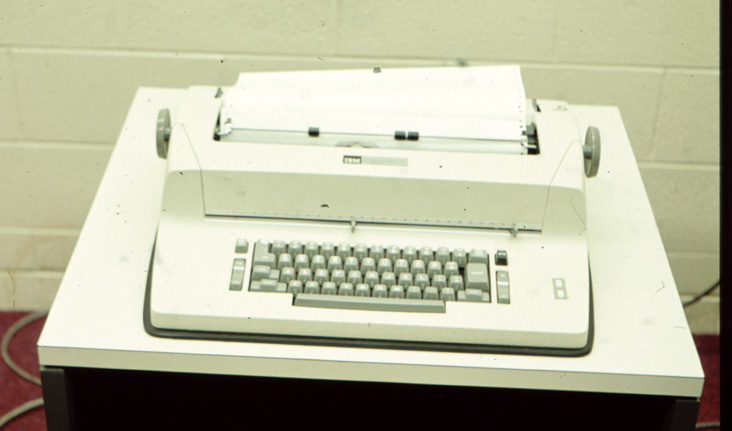

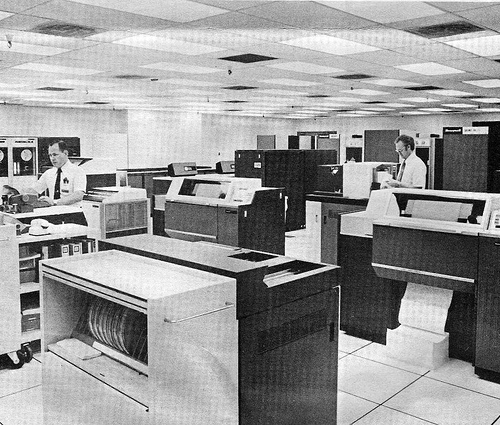

I first used computers at age 14, after being invited with a set of Math Contest winners to the University of Waterloo where I had the pleasure of using APL an early math-based timesharing system running on an IBM 360/44 . It is notable that, rather than learning the standard Fortran and programming on punch cards, I started programming using an IBM 2741, which is like an online IBM Selectric typewriter (typeball and all) connected via modem, with acoustic coupler, at 134.5 baud. Prior to this, I had read about computers and thought about them abstractly, but the plain truth is that computers were only accessible to a very small, privileged elite.

I first used computers at age 14, after being invited with a set of Math Contest winners to the University of Waterloo where I had the pleasure of using APL an early math-based timesharing system running on an IBM 360/44 . It is notable that, rather than learning the standard Fortran and programming on punch cards, I started programming using an IBM 2741, which is like an online IBM Selectric typewriter (typeball and all) connected via modem, with acoustic coupler, at 134.5 baud. Prior to this, I had read about computers and thought about them abstractly, but the plain truth is that computers were only accessible to a very small, privileged elite. Recently, a friend sent me the directory listing of an old backup tape for the Honeywell 6050 TSS system which reminded me that I first used email in 1975. Yes, we even had mailbox and mbox files way back then. Of course, the email system only connected the almost 1000 users of this computer, yet barely two years later my friend Bill Pase then working at IP Sharp Associates, connected me into a truly global email system run by that pioneering firm. This is primarily of interest because many people I talk to assume that email began in the late 1990’s.

Recently, a friend sent me the directory listing of an old backup tape for the Honeywell 6050 TSS system which reminded me that I first used email in 1975. Yes, we even had mailbox and mbox files way back then. Of course, the email system only connected the almost 1000 users of this computer, yet barely two years later my friend Bill Pase then working at IP Sharp Associates, connected me into a truly global email system run by that pioneering firm. This is primarily of interest because many people I talk to assume that email began in the late 1990’s. Around 1990, while CEO at

Around 1990, while CEO at

21 Mar 2009

0 CommentsMeeting Productivity: Central Planning Versus the Market

The 20th Century was defined by an ill-fated search for a better world, inspired by late 19th Century, Victorian thinking. The irony, then, is that the 20th Century turned out to be probably the most destructive in human history, based on often misguided applications of powerful new technologies.

If you define a utopian society as one where governments plan to have zero unemployment, stable economic growth and high personal well being, how have we done in planning for this world? Up to now, in a word, wretchedly.

A personal defining moment was when I journeyed behind the Berlin Wall to East Berlin in 1989. This was just before the Soviet Bloc, along with its vassal state the German Democratic Republic, spectacularly imploded on 9 November, 1989. While I had previously sympathized with the notion that a socialist government could plan to make the world a better place, the dismal comparison of the East and West that I saw then graphically disabused me, forever, of that notion. East Berlin was a drab, grey, unpainted city in which even the prominent public buildings still had 45 year old bullet holes from World War II.

Communism, coupled with its less extreme relation socialism, and fascism were the defining, centrally planned ideologies of the 20th Century. Then, everything was planned and and organized from the top down, from prime time television, to the Stalinist 5 year plan to the Nazi Thousand Year Reich. With that hopeless track record, will we ever figure out how to move closer to a utopian reality?

Today I will explore some of the innovations in our understanding that might lead to that end.The book Infotopia, by Cass R. Sunstein is a truly outstanding study of the power of democracy in decision making for our internet age. Rather counterintuitively, this insightful book presents a well-researched argument that in group decision making, Deliberation (or central planning) almost always produces inferior results to Democracy (the wisdom of many people, driven by markets, to reach the truth).

Some key insights are:

This book should be mandatory reading for politicians, business leaders and anyone wanting to shape the world of the 21st Century. From how to conduct better meetings to how to make the world a better place, Infotopia provides a solid foundation of how to harness better decision making for the future.