5 Mar 2023

0 CommentsAdrenaline Fund Continues to Power Early Stage Ecosystem in 2022

Adrenaline Fund marks its second full year of investing as it completed its 2022 Vintage. Adrenaline Fund, was founded in 2020 as part of the multi-fund Archangel Network of Funds, uniquely applies a hyper efficient passive model, fuelled by our startup and angel ecosystem, to early stage investing. .

We are fuelled by a remarkable group of Limited Partners who are accredited investors interested in our Purpose and coupled with the high return prospects delivered via a highly diversified portfolio

PURPOSE

The entire team at Archangel Network of Funds, and the Adrenaline Fund, is driven by a core Purpose, developed over years of building and supporting early-stage companies. In a nutshell, we want to directly impact Canada’s economic prosperity into the future by:

- Investing in Entrepreneurs who are building the future of the Canadian Economy through Innovation,

- Lowering barriers for accredited investors to participate in, and gain more experience, in early stage investing, and

- Accelerating, and directly supporting, the Canadian Angel ecosystem while enabling Canadian startups to scale up to global leadership.

In this post, I’ll further explore our unique model, an exceptional team, what we’ve done so far, and propose a future where this impact can grow many times larger than our results to date.

TEAM

PORTFOLIO

The 2022 vintage portfolio, reflecting a broad diversity of sectors and stages, comprises 10 great companies:

- Technology: 3

- Medical Technology: 3

- Industry 4.0: 3

- Climate: 1

They join the 10 companies already in our 2021 Vintage, and listed in our post describing the results of our 2021 Adrenaline Vintage: Adrenaline Fund Pumps a High Energy First Year into Early Stage Investing.

We are excited to welcome the following companies to our Adrenaline Fund portfolio, reflecting the powerful value-adds of the Angel Ecosystem we support:

- enables smart communities and organizations to leverage IoT with powerful sensor-based platform.

- develops advanced molecular simulation to enable drug design through fusing chemistry, physics and AI-based computer modelling

- smart manufacturing company that has developed automated lab equipment and smart software to perform material tensile and tear testing

- creating digital gynecology to allow clinicians by modernizing care for women suffering from an underserved and stigmatized women’s health issue

- fuses virtual reality to real world entertainment experiences

- delivers an engaging carbon measurement platform to empower organizations to a more sustainable future

- delivers microfluidics SPR diagnostic testing directly to the lab benchtop

- fintech delivering business banking for global companies

- a peer-grading platform enabling a new era of education

- applying Thrust Vectoring technology to stabilize drones for specialized industrial applications

MODEL AND WHY IT WORKS

As mentioned, we believe that the Adrenaline Fund model and thesis is unique in Canada, by fusing the power of a passive approach (like an ETF in the public markets) to the early-stage Angel investment ecosystem.

First of all, the investment decision is designed to support the existing Angel ecosystem through a set of rules to govern the investment process. At a high level, the Rules, shared with LPs, stay largely the same but are tuned in response to changes in the ecosystem. Thus, rather than active decisions, the focus is on tuning the rules and working to ensure that the angel and startup ecosystem remain of high value.

A colleague questioned the wisdom of, such a “blind investment process”, suggesting it is a bit crazy and perhaps akin to wagering on slot machines. Nothing could be further from the truth. The secret sauce of Adrenaline is the collective value-add of the ‘qualified lead investors’ who mentor and provide ongoing strategic oversight (e.g. as a board member or board observer).

In fact, research by Brian Smith, Professor of Entrepreneurship and Finance at Wilfrid Laurier University along with global tech investment trends studied by BDC Ventures, shows an almost 25 times multiplier of success for such angel-backed companies. In summary, in generating larger ‘Scale Up’ companies (with valuations reaching US$250M), Canada has a dismal 0.3% track record (or 1 in 300) compared to the 2.5% that reach that scale in the US (or 1 in 40). Within the Angel ecosystem, specifically GTAN where the study was conducted, an amazing 8% of investee companies reached the $250M threshold. Unpacking the reasons for this incredible out-performance would include factors like: the GTAN selection process, the ongoing value-adds of experienced ‘deal leads’, the strength of the Toronto-Waterloo Tech Corridor ecosystem where GTAN focuses, and syndication with other capable seed/angel stage investment funds.

Further, he model is structured to be open and accessible to the greatest number of Accredited Investors by having the aggregate investment staged over 5 equal annual cash instalments (say $250,000 at $50,000 per year). Since the fund is structured to segregate ‘Vintage Years’, and each Vintage aims to invest in 9-10 companies per year, this ensures a diversified portfolio of about 50 companies at an extremely affordable entry point. The Vintage structure allows new LPs to join once at the beginning of each year, thus growing the maximum amount of each Adrenaline investment and helping startups even more.

Most importantly, the fund attracts investments from individuals new to angel investing since it provides a simple and time efficient path potentially learn more. Quite simply, we are unlocking new capital to support Canadian innovation.

JOIN US

Feel free to reach out to any of us to learn more and get involved. We’d love to have you on board.

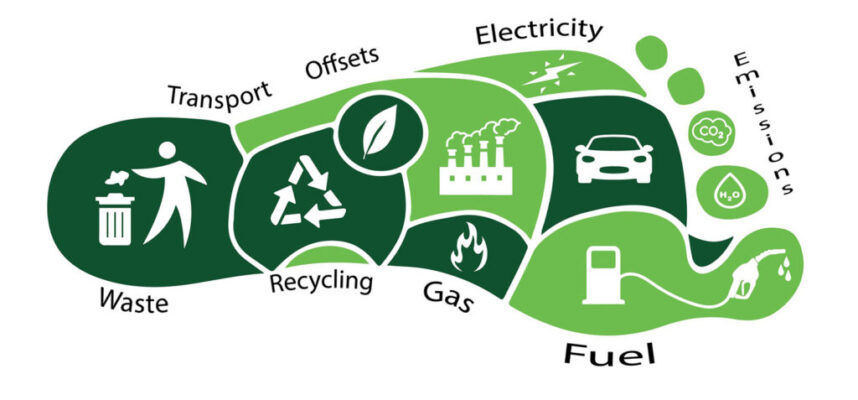

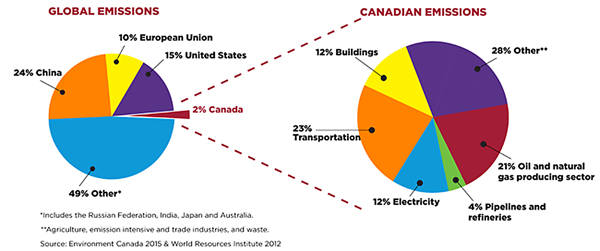

Being a northern nation with really cold winters, means that our homes consume a lot of energy which can be between 20- 25% of our personal carbon footprints. In most of Canada, it takes a lot of energy for home heating as well as cooling and domestic hot water. We also use loads of energy for cooking, laundry, home entertainment, lighting and more.

Being a northern nation with really cold winters, means that our homes consume a lot of energy which can be between 20- 25% of our personal carbon footprints. In most of Canada, it takes a lot of energy for home heating as well as cooling and domestic hot water. We also use loads of energy for cooking, laundry, home entertainment, lighting and more. The old adage of ‘Reduce, Re-use, Recycle’, and in that order, remains true even now. We live in a society where consumption, beyond any real need, has taken hold. And, it is harder to buy quality products that last – witness of the incredibly ugly footprint caused by the trend to ‘Fast Fashion’.

The old adage of ‘Reduce, Re-use, Recycle’, and in that order, remains true even now. We live in a society where consumption, beyond any real need, has taken hold. And, it is harder to buy quality products that last – witness of the incredibly ugly footprint caused by the trend to ‘Fast Fashion’.

In a

In a

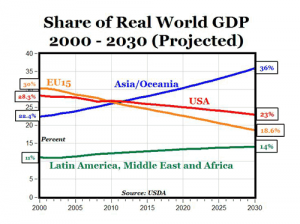

Source: Wall Street Pit

Source: Wall Street Pit

Randall (郝狼盾)Looking east and savouring the journey..

Randall (郝狼盾)Looking east and savouring the journey..

In our 3rd year, some exciting changes are afoot as we see our vision for the Prize unfold.

In our 3rd year, some exciting changes are afoot as we see our vision for the Prize unfold.

1 Jan 2024

0 CommentsAdrenaline Fund Completes 2023 Investments

Happy New Year!

Today is the first day of 2024, starting the fourth year of Adrenaline Fund which completed its 2023 Vintage int late December. To summarize, as per our plan during 2023, the Adrenaline team made 10 new investments bringing the three year total to 30 investments This puts us on track to deliver a highly diversified portfolio of approximately 50 amazing early stage companies to our founding LPs by the end of next year.

Adrenaline Fund, founded in 2020 as part of the multi-fund Archangel Network of Funds, uniquely applies a hyper efficient rules-based model to early stage investing, supporting and supported by the ‘crowd intelligence’ of our startup and angel ecosystem.

We are fuelled by a remarkable group of Limited Partners — Canadian accredited investors equally interested in our Purpose to build economically vibrant Canadian future and the prospect of the excellent Returns delivered by such a highly diversified portfolio.

While like vintage wine, tech portfolios take time to build to perfection, already Adrenaline Fund has its first Exit, with an acquisition in progress, slated to close this month.

PURPOSE

The entire team at Archangel Network of Funds, and the Adrenaline Fund, is driven by a core Purpose, developed over years of building and supporting early-stage companies. In a nutshell, we want to directly impact Canada’s economic prosperity into the future by:

In this post, I’ll further explore our unique model, an exceptional team, what we’ve done so far, and propose a future where this impact can grow many times larger than our results to date.

TEAM

PORTFOLIO

To update on recent progress, the 2023 Vintage portfolio, reflecting a broad diversity of sectors and stages, comprises 10 great companies, below (the first number shows 2023 and the second the total portfolio to date):

To clarify the above sector brakdown:

Also, many of our investments meld a strong Purpose with Profits, including addressing predatory lending and helping make home ownership more accessible.

These following 10 Vintage 2023 companies join the 20 companies already in our 2021 Vintage and 2022 Vintage.

We are excited to welcome the following companies to our Adrenaline Fund portfolio, reflecting the powerful value-adds of the Angel Ecosystem we support:

MODEL AND WHY IT WORKS

As mentioned, we believe that the Adrenaline Fund model and thesis is unique in Canada, by fusing the power of a rules-based approach to the early-stage Angel investment ecosystem. By efficiently delivering a large, diversified portfolio of high quality companies, we uniquely open access to a much broader class of angel investors.

First of all, the investment decision is designed to support the existing Angel ecosystem through a set of rules to govern the investment process. At a high level, the Rules, remain consistent over the longer term, but are tuned in response to changes in the ecosystem.

A colleague questioned the wisdom of, such a “blind investment process”, suggesting it is a bit crazy and perhaps akin to wagering on slot machines. Nothing could be further from the truth. The secret sauce of Adrenaline is the collective value-add of the ‘qualified lead investors’ who after investment contintue to mentor and provide ongoing strategic oversight (e.g. as a board member or board observer).

In fact, research by Brian Smith, Professor of Entrepreneurship and Finance at Wilfrid Laurier University along with global tech investment trends studied by BDC Ventures, shows an almost 25 times multiplier of success for such angel-backed companies who benefit from the value add of the angel networks.

The research numbers show that in generating larger ‘Scale Up’ companies (with valuations reaching US$250M), Canada overall has a dismal 0.3% track record (or 1 in 300) compared to the 2.5% that reach that scale in the US (or 1 in 40).

By contrast, within the Angel ecosystem, specifically GTAN where the study was conducted, an amazing 8% of investee companies reached the $250M threshold. Unpacking the reasons for this remarkable out-performance would include factors like: the GTAN selection process, the ongoing value-adds of experienced ‘deal leads’, the strength of the Toronto-Waterloo Tech Corridor ecosystem where GTAN focuses, and syndication with other capable seed/angel stage investment funds.

Further, the Adrenaline Fund model is structured to be open and accessible to the greatest number of Canadian Accredited Investors by having the aggregate investment staged over 5 equal annual cash instalments (say $250,000 at $50,000 per year). Since the fund is structured to segregate ‘Vintage Years’, and each Vintage aims to invest in 9-10 companies per year, this ensures a diversified portfolio of about 50 companies at an extremely affordable entry point. The Vintage structure allows new LPs to join once at the beginning of each year, thus growing the maximum amount of each Adrenaline investment and helping startups even more.

Most importantly, the fund attracts investments from individuals new to angel investing since it provides a simple and time efficient path potentially learn more. Quite simply, we are unlocking new capital to support Canadian innovation.

JOIN US

Feel free to reach out to any of us to learn more and get involved. We’d love to have you on board.