5 May 2009

0 CommentsA “Rare” Tasting Menu by R Murray Shafer

“Dawn itself is the most neglected masterpiece of the modern world.” – R Murray Shafer

For those who don’t already know him, R Murray Shafer is the legendary superstar of the Canadian Musical avant garde – a great thinker, teacher, composer and all round renaissance man.

Having been a fan for over 30 years but with little local exposure, it was great to see his Harbingers of Spring: a rare soundwalk presented last week in Waterloo Region. I’ve had the great fortune to have experienced many of his masterworks, especially those from his ambitious, 12 part Patria series, including The Princess of the Stars, Ra and The Enchanted Forest. Each concert is a one of a kind, tour de force combining music, theatre, philosophy many times based on classic mythologies and almost always set in the natural environment.

The soundwalk event was really a set of mini-concerts stitched together during a 3 hour walk through the breathtaking, almost 1000 acre rare property at the confluence of the Speed and the Grand Rivers in Cambridge. First and foremost, a brilliant thought leader and writer, Shafer opened with some great concepts:

- Sounds and music, never originated in the sterile, acoustically engineered, concert hall. Their natural habitat is outdoors.

- Most early cultures could hear both nearby sounds, such as birds or the trees, but also far off sounds, (maybe even 20-30 km) by “putting their ear to the ground”.

- Being acutely atuned to ambient sounds wasn’t just an aesthetic sense, it was also essential to survival.

- It is possible to hear even the sound of “trees growing in the woods”. This isn’t just the lovely sound of wind in leaves, but also the sound of sap rushing through the trees. Each species of tree has its own distinctive sound (music?) both in growing and in the way it interacts with the wind.

- Sadly, our modern, urban population has lost its ability to hear more than the most immediate sounds – the white noise of traffic, car horns and the ubiquitous music such as in Starbucks drown out any ability to hear anything further afield. Along with this, perhaps we have lost our ability to “hear” the very ecosystem we inhabit.

Finally, Shafer concludes with his vision that re-connecting people with their audible environment might well be essential to the very survival of our environmentally challenged planet.

Including premieres and works inspired by Shafer’s engaging, nay idiosyncratic, style, some of the pieces included:

- Radio Rare Woods (world premier) by Ellen and Michael Waterman, including first a live performance of the Nocturne for Solo Flute from Shafer’s Wolf Music, composed in 1996, followed by echoes played over several dozen radio receivers strategically arrayed thoughout the wood walk. Certainly, a juxtaposition of the urban and natural environments.

- From the Bow a poem by Rae Crossman, set to clarinet music written by Murray Shafer.

- Excerpts from The Enchanted Forest and Aubade for Solo Voice by Murray Shafer is a wonderful example of the music coming to life in the setting of a forest. The music elicits a live response from birds and other wildlife in a way that is more alive than anything seen in any concert hall. It was truly awe inspiring.

- Transportation Transoformation in Shades of Rust (world premier) by Annette Urbschat and Todd Harrop presented an improvisation using a quintessential 20th century intruder, in the shape of a wrecked car, which acts both as set and source of musical instruments.

- The Acoustic Locator (world premier) by Nina Leo was a large ear horn that could swivel through an entire 360 degree rotation enabling each audience member to connect with the audible landscape in a very intimate way indeed.

In closing, kudos to the organizers for their sense of promoting the power of partnership in the arts. Just like in for profit businesses, this kind of pairing can build a powerful gestalt where the sum is greater thant the parts.

In closing, kudos to the organizers for their sense of promoting the power of partnership in the arts. Just like in for profit businesses, this kind of pairing can build a powerful gestalt where the sum is greater thant the parts.

The Soundwalk was presented as part of the Open Ears Festival of Music and Sound, which is an electic mix spanning avant garde to classical and electroacoustics to sound installations. The festival is a “spin-out” of the KW Symphony Orchestra under Artistic Director Peter Hatch and produced jointly with NUMUS. What was exciting was that this event was produced with a charitable natural reserve decicated to research. Like R Murray Shafer, the event was a fusion of togetherness of the arts and environment in Waterloo Region. This is exactly the kind of “big tent” strength through partnership envisaged by the September 2008 Prosperity Council of Waterloo Region: Task Force on Creative Enterprise.

Credit: AIAlex.com

Credit: AIAlex.com Unlike this sign, I don’t want to end this piece on a note of doom and gloom. Nor do I want to leave the impression that there aren’t very talented people in the Canadian VC industry. Nothing could be further from the truth – our long term VC gap arises from long term structural challenges, such as a lack of discipline as imposed by global LPs and not having reached the proper banker/operator mix. There are other factors, including the small population and large geography unique to Canada, but all can be and should be overcome with the proper model.

Unlike this sign, I don’t want to end this piece on a note of doom and gloom. Nor do I want to leave the impression that there aren’t very talented people in the Canadian VC industry. Nothing could be further from the truth – our long term VC gap arises from long term structural challenges, such as a lack of discipline as imposed by global LPs and not having reached the proper banker/operator mix. There are other factors, including the small population and large geography unique to Canada, but all can be and should be overcome with the proper model.

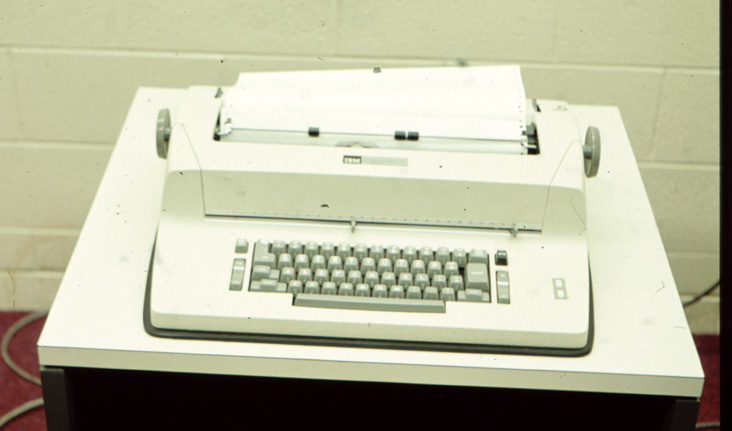

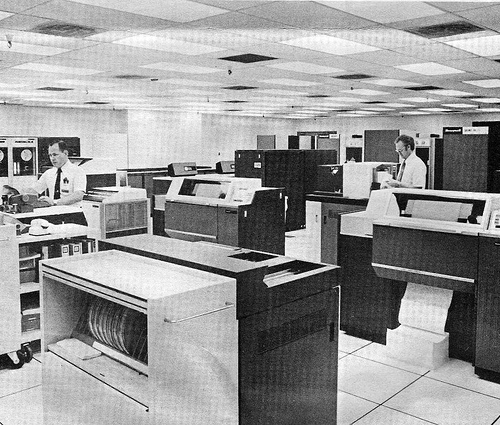

I first used computers at age 14, after being invited with a set of Math Contest winners to the University of Waterloo where I had the pleasure of using APL an early math-based timesharing system running on an IBM 360/44 . It is notable that, rather than learning the standard Fortran and programming on punch cards, I started programming using an IBM 2741, which is like an online IBM Selectric typewriter (typeball and all) connected via modem, with acoustic coupler, at 134.5 baud. Prior to this, I had read about computers and thought about them abstractly, but the plain truth is that computers were only accessible to a very small, privileged elite.

I first used computers at age 14, after being invited with a set of Math Contest winners to the University of Waterloo where I had the pleasure of using APL an early math-based timesharing system running on an IBM 360/44 . It is notable that, rather than learning the standard Fortran and programming on punch cards, I started programming using an IBM 2741, which is like an online IBM Selectric typewriter (typeball and all) connected via modem, with acoustic coupler, at 134.5 baud. Prior to this, I had read about computers and thought about them abstractly, but the plain truth is that computers were only accessible to a very small, privileged elite. Recently, a friend sent me the directory listing of an old backup tape for the Honeywell 6050 TSS system which reminded me that I first used email in 1975. Yes, we even had mailbox and mbox files way back then. Of course, the email system only connected the almost 1000 users of this computer, yet barely two years later my friend Bill Pase then working at IP Sharp Associates, connected me into a truly global email system run by that pioneering firm. This is primarily of interest because many people I talk to assume that email began in the late 1990’s.

Recently, a friend sent me the directory listing of an old backup tape for the Honeywell 6050 TSS system which reminded me that I first used email in 1975. Yes, we even had mailbox and mbox files way back then. Of course, the email system only connected the almost 1000 users of this computer, yet barely two years later my friend Bill Pase then working at IP Sharp Associates, connected me into a truly global email system run by that pioneering firm. This is primarily of interest because many people I talk to assume that email began in the late 1990’s. Around 1990, while CEO at

Around 1990, while CEO at

Avvey Peters from Waterloo’s

Avvey Peters from Waterloo’s  Alec Saunders, CEO of one of Canada’s most promising web/mobile startups,

Alec Saunders, CEO of one of Canada’s most promising web/mobile startups,  Peter Childs, an Ottawa social media strategist and tech luminary, has laid out a framework

Peter Childs, an Ottawa social media strategist and tech luminary, has laid out a framework

20 Jul 2009

0 CommentsHas Microsoft Morphed from “Hungry/Nimble” Startup to “Fat/Stupid” Behemoth?

While I typically leave reviews of even major new products to others, my personal experience in the much heralded Windows 7 Beta to launch process provides some interesting observations on the difference between large and small companhies in early adopter customer engagement.

Having bought an early Asus eeePC netbook almost 2 years ago and finding that early product both intriguing yet frustrating, I purchased the newly launched HP 2140 HD netbook when it launched in late June. This is a well engineering product that has clearly crossed the useability threshhold for uber mobility.

Like most netbooks, it comes standard with Windows XP Home. This was just fine because I, like the majority of Windows desktop users, wisely passed on the miasma that is also known as Windows Vista.

However, having heard some reports that the Windows 7 Beta was showing some promise and recognizing that running an operating system originally launched in 2003 wasn’t a viable long term strategy, I decided to upgrade to the Windows 7 Beta (now Release Candidate).

Overall, apart from the bugs inherent in any Beta,

the system has a clean modern design, seems to perform well and certainly is in no way like the Vista fiasco.

Sadly, Microsoft, I quickly learned, made a choice to not provide any upgrade path from XP to Windows 7. Yes, you heard right. In spite of the fact that the majority of users sagely gave Windows Vista the miss, Microsoft chose to provide a seamless upgrade path only for Vista users. While Microsoft perhaps feels that Windows XP is now an obsolete product, remember that most netbook companies are still shipping XP, so XP is truly a current system that people continue to buy. What did this mean to my early adopter experience with Windows 7?

So, as one who works with young and hungry startups, I look at this decision through a management decision making lens. Would a startup chose to cause such pain and grief to the majority of their installed base? Not a chance!

However, I have noticed that somehow, and inexorably, nimble startups eventually ossify into larger and more mature enterprises. And the decision making becomes more about risk and ROI and less about the customer. Is this what’s happening at Microsoft?

The history at Microsoft is interesting. Bill Gates, from the earliest days, was paranoid about being eclipsed by the greater resources of companies like IBM. Today, as the desktop operating system become more irrelevant, Microsoft’s paranoia is aimed at other firms like Google, which interesting announced their own OS for Netbooks last week. Perhaps the transition from Bill Gates to Steve Ballmer at the helm, there is less acute customer focus? In any case, no startup would ever even conceive of disenfranchising a customer base so completely.

What do market statistics show us about the size of Microsoft’s problem? A Decmber 2008 report from OneStat indicates that for Operating Systems, Windows Vista has managed a mere 21% compared to Windows XP having a powerful 72% share which is 3 to 4 times larger. The fact the XP is good enough for most customers is a real problem for Microsoft, representing among other things, significant loss of revenue (and relevance).

Is an individual user’s frustrating experience something Microsoft should be looking at? Absolutely. Consider CNET’s recent discussion of respected analyst Garnter’s assertion that Vista probably has put Microsoft into its first major set of layoffs ever: Gartner: Blame Vista for Microsoft Layoffs. This excerpt says it all:

Even a big and market leader like Coke learned from their mistakes. Will Microsoft return to its roots and see the light with Windows 7?