1 Jan 2024

0 CommentsAdrenaline Fund Completes 2023 Investments

Happy New Year!

Today is the first day of 2024, starting the fourth year of Adrenaline Fund which completed its 2023 Vintage int late December. To summarize, as per our plan during 2023, the Adrenaline team made 10 new investments bringing the three year total to 30 investments This puts us on track to deliver a highly diversified portfolio of approximately 50 amazing early stage companies to our founding LPs by the end of next year.

Adrenaline Fund, founded in 2020 as part of the multi-fund Archangel Network of Funds, uniquely applies a hyper efficient rules-based model to early stage investing, supporting and supported by the ‘crowd intelligence’ of our startup and angel ecosystem.

We are fuelled by a remarkable group of Limited Partners — Canadian accredited investors equally interested in our Purpose to build economically vibrant Canadian future and the prospect of the excellent Returns delivered by such a highly diversified portfolio.

While like vintage wine, tech portfolios take time to build to perfection, already Adrenaline Fund has its first Exit, with an acquisition in progress, slated to close this month.

PURPOSE

The entire team at Archangel Network of Funds, and the Adrenaline Fund, is driven by a core Purpose, developed over years of building and supporting early-stage companies. In a nutshell, we want to directly impact Canada’s economic prosperity into the future by:

- Investing in Entrepreneurs who are building the future of the Canadian Economy through Innovation,

- Lowering barriers for accredited investors to participate in, and gain more experience, in early stage investing, and

- Accelerating, and directly supporting, the Canadian Angel ecosystem while enabling Canadian startups to scale up to global leadership.

In this post, I’ll further explore our unique model, an exceptional team, what we’ve done so far, and propose a future where this impact can grow many times larger than our results to date.

TEAM

The Adrenaline Fund team has unparallelled experience in building companies, mentoring startups and selecting and investing in the next generation of Canada’s tech leaders but at the early stages. In addition to myself, our team includes Benton Leong and Amber French, and is ably complemented by Venture Partners Mike Janzen and Althea Wishloff.

The Adrenaline Fund team has unparallelled experience in building companies, mentoring startups and selecting and investing in the next generation of Canada’s tech leaders but at the early stages. In addition to myself, our team includes Benton Leong and Amber French, and is ably complemented by Venture Partners Mike Janzen and Althea Wishloff.

PORTFOLIO

To update on recent progress, the 2023 Vintage portfolio, reflecting a broad diversity of sectors and stages, comprises 10 great companies, below (the first number shows 2023 and the second the total portfolio to date):

- Technology: 4 / 12

- Medical Technology: 2 / 8

- Industry 4.0: 2 / 7

- Climate Tech: 2 / 3

To clarify the above sector brakdown:

- Technology includes most traditional ICT including software, networking, AI and FinTech, and more.

- Industry 4.0 covers technologies revolutionizing industry and manufacturing, including robotics and smart manufacturing.

- Climate Tech covers a broad range from traditional Clean Tech but also including sustainable AgTech and FoodTech all focused on a more sustainable future.

Also, many of our investments meld a strong Purpose with Profits, including addressing predatory lending and helping make home ownership more accessible.

These following 10 Vintage 2023 companies join the 20 companies already in our 2021 Vintage and 2022 Vintage.

We are excited to welcome the following companies to our Adrenaline Fund portfolio, reflecting the powerful value-adds of the Angel Ecosystem we support:

- engineering-grade AR & AI-powered digital twin technology for infrastructure

- supports those struggling under the weight of predatory lending

- simplifies end-to-end home ownership

- electrifying recreational boating with high performance, zero emissions hydrofoiling technology

- coordinates virtual healthcare with a digital health platform and marketplace

- developing JVPHome device capable of assessing ugular venous pressure treating congestive heart failure

- providing VR enabled robot control platforms and solutions

- delivers data driven, GDPR compliant real world analytics

- enabling home ownership via a rent to own platform

- delivers AI powered Mining equipment maintenance lowering carbon footprint

MODEL AND WHY IT WORKS

As mentioned, we believe that the Adrenaline Fund model and thesis is unique in Canada, by fusing the power of a rules-based approach to the early-stage Angel investment ecosystem. By efficiently delivering a large, diversified portfolio of high quality companies, we uniquely open access to a much broader class of angel investors.

First of all, the investment decision is designed to support the existing Angel ecosystem through a set of rules to govern the investment process. At a high level, the Rules, remain consistent over the longer term, but are tuned in response to changes in the ecosystem.

A colleague questioned the wisdom of, such a “blind investment process”, suggesting it is a bit crazy and perhaps akin to wagering on slot machines. Nothing could be further from the truth. The secret sauce of Adrenaline is the collective value-add of the ‘qualified lead investors’ who after investment contintue to mentor and provide ongoing strategic oversight (e.g. as a board member or board observer).

In fact, research by Brian Smith, Professor of Entrepreneurship and Finance at Wilfrid Laurier University along with global tech investment trends studied by BDC Ventures, shows an almost 25 times multiplier of success for such angel-backed companies who benefit from the value add of the angel networks.

The research numbers show that in generating larger ‘Scale Up’ companies (with valuations reaching US$250M), Canada overall has a dismal 0.3% track record (or 1 in 300) compared to the 2.5% that reach that scale in the US (or 1 in 40).

By contrast, within the Angel ecosystem, specifically GTAN where the study was conducted, an amazing 8% of investee companies reached the $250M threshold. Unpacking the reasons for this remarkable out-performance would include factors like: the GTAN selection process, the ongoing value-adds of experienced ‘deal leads’, the strength of the Toronto-Waterloo Tech Corridor ecosystem where GTAN focuses, and syndication with other capable seed/angel stage investment funds.

Further, the Adrenaline Fund model is structured to be open and accessible to the greatest number of Canadian Accredited Investors by having the aggregate investment staged over 5 equal annual cash instalments (say $250,000 at $50,000 per year). Since the fund is structured to segregate ‘Vintage Years’, and each Vintage aims to invest in 9-10 companies per year, this ensures a diversified portfolio of about 50 companies at an extremely affordable entry point. The Vintage structure allows new LPs to join once at the beginning of each year, thus growing the maximum amount of each Adrenaline investment and helping startups even more.

Most importantly, the fund attracts investments from individuals new to angel investing since it provides a simple and time efficient path potentially learn more. Quite simply, we are unlocking new capital to support Canadian innovation.

JOIN US

Feel free to reach out to any of us to learn more and get involved. We’d love to have you on board.

The Archangel Network of Funds model involves a team with even greater breadth, many of whom are pictured above. Years of strategic business leadership, coupled with some of the most sophisticated selection and investment savvy, are a big part of what makes Adrenaline unique.

The Archangel Network of Funds model involves a team with even greater breadth, many of whom are pictured above. Years of strategic business leadership, coupled with some of the most sophisticated selection and investment savvy, are a big part of what makes Adrenaline unique.

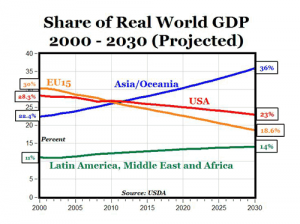

Source: Wall Street Pit

Source: Wall Street Pit

Randall (郝狼盾)Looking east and savouring the journey..

Randall (郝狼盾)Looking east and savouring the journey..

In our 3rd year, some exciting changes are afoot as we see our vision for the Prize unfold.

In our 3rd year, some exciting changes are afoot as we see our vision for the Prize unfold.

Pitching in Istanbul

Pitching in Istanbul

2 Jan 2025

0 CommentsWaterloo Tech – Ancient Acetates from the Early Years

Happy New Year, 2025!

During personal housecleaning, I came across a file folder, with the overhead acetates of a Powerpoint presentation I had thought long vanished.

Back in 1993, Yvan Couture and I co-founded a CEO group for Waterloo area (then including Guelph) technology industry CEOs, later known as Atlas Group,. By our second year, we had all gained immensely from a forum where we could learn together in a peer-to-peer mechanism. And as most of us were jet-setting, high export business leaders, it was good to reflect on what we could share locally in our community. As we compared notes, we realized that we needed to work together to better tell our story, including to various levels of government who had yet to fully understand the transformative potential of the new knowledge-based business paradigm we represented.

On October 27, 1994, we chartered 2 small planes from Waterloo International Airport to fly 15 of us to Ottawa to tell our story to the federal government. Assisted by the late Andrew Telegdi, Waterloo MP at the time, we booked meetings with John Manley, the iconic Minister of Industry, Jean Chrétien, Canada’s Prime Minister, and Ottawa tech leaders, such as Michael Cowpland.

We collectively developed the following Powerpoint to present up in Ottawa, and the group asked me to present to our leaders. The featured image on this posting is a photo taken in the Speaker’s Library in the House of Commons.

The following is the recently uncovered Powerpoint from October 1994.

Ottawa Delegation Powerpoint Oct 1994The following is a scan of the base data used in preparing the Powerpoint, giving an impressive 5 year growth trajectory.

To make it easier to read, I have re-entered the data in a table below.

Some observations that are reflective of those times:

Since Waterloo’s tech industry started in the early to mid 1990s, it took a decade for this first generation cohort to gain critical mass, and also to start to do major financings. Within 1-2 years of our Ottawa trip, the majority of us had done an IPO, Special Warrant Transaction or were acquired.

The second part of the Powerpoint presentation talks about a proposed “Internet 2000 Consortium”. Although I’m hoping someone can remind what ultimately happened to this visionary proposal, the idea was to get the entire Waterloo community (business, government, schools, etc) working together to make the region an internet powerhouse. For example, MKS was shortly to release MKS Internet Anywhere, followed by the world’s first Web Content Management product MKS Web Integrity. Open Text produced Open Text Web Index one of the world’s first internet search engines which was sadly outspent first by Digital Equipment Corporation‘s Altavista and later Google. Although we reserved our domain (mks.com back in 1985, the internet was still dialup in nature. To transcdnd that, several of us shared costs of a T1 (a fixed broadband connection at a blazing fast 1.5MB/sec rate).

Collectively, the presentation highlights rapid growth and economic impact, and predicts big things ahead:

This delegation proved that the Waterloo tech phenomenon had moved beyond a few visionary entrepreneurs to becoming a true force in the Canadian, and global, economies.

The Atlas Group continued for several more years — eventually passing its peer-to-peer leadership torch by building an organization bigger than any one of our companies. The group wrote a business plan and also wrote cheques (and yes people still used paper cheques back then) to fund a year long experiment they named Communitech. That legacy of entrepreneurs trying to collectively move the needle on a tech growth engine for both the region and Canada, lives on today.