“How You Gonna Keep ‘Em Down On The Farm” (excerpt) by Andrew Bird

Oh, how ya gonna keep ’em down? Oh no, oh no

Oh, how ya gonna keep ’em down?

How ya gonna keep ’em away from Broadway?

Jazzin’ around and painting the town?

How ya gonna keep ’em away from harm?

That’s the mystery

______________________

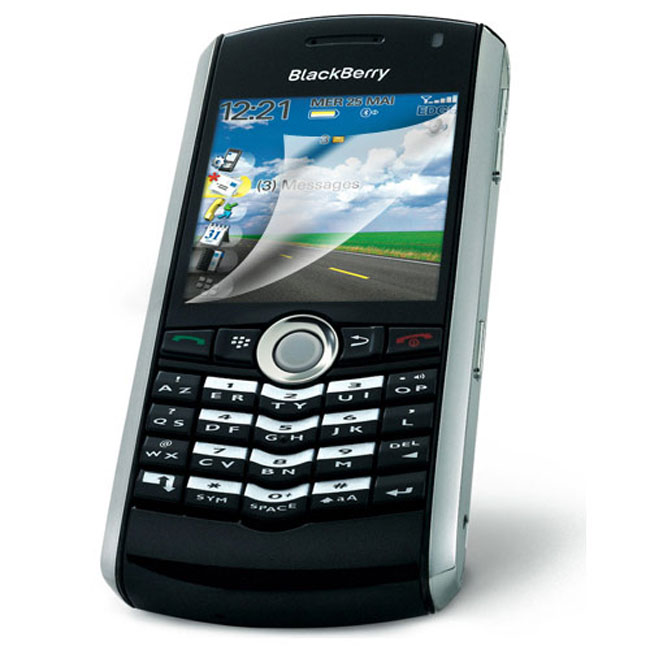

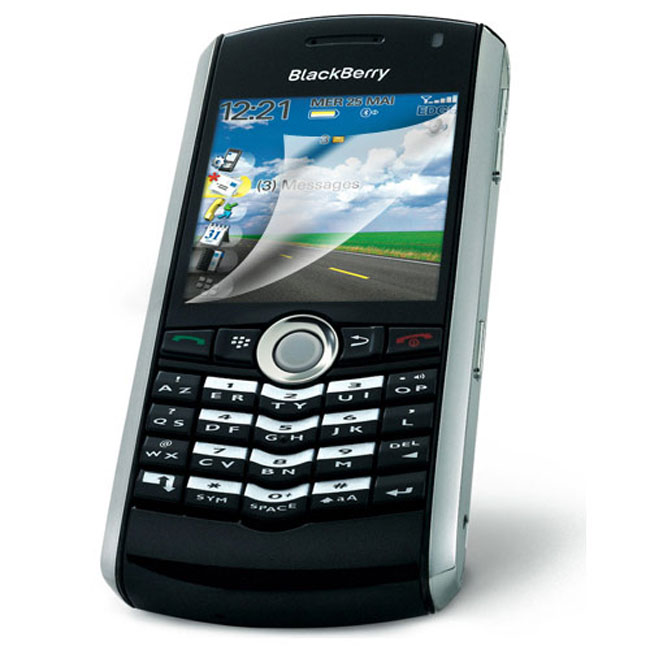

This week, my 18 month old Blackberry finally bit the dust. Out of this came a realization that led me to the challenge I issue at the end of this post.

Please don’t view my device failure to be a reflection on the reliability, or lack thereof, of Blackberry handsets. Rather, as a heavy user, I’ve found that the half life of my handsets is typically 18 to 24 months before things start to degrade – indeed, mobile devices do take a beating.

The obsolescence of one device is, however, a great opportunity to reflect on the age-old question: What do I acquire next? That is the subject of this posting, which focuses on the quantum changes in the mobile and smartphone market over the last couple of years.

I’ll start with a description of my smartphone usage patterns. Note that, in a later post, I plan to discuss how all this fits into a personal, multi-year odyssey toward greater mobile productivity across a range of converged devices and leveraging the cloud. Clearly, my smartphone use is just a part of that.

I’ll start with a description of my smartphone usage patterns. Note that, in a later post, I plan to discuss how all this fits into a personal, multi-year odyssey toward greater mobile productivity across a range of converged devices and leveraging the cloud. Clearly, my smartphone use is just a part of that.

I’ve had Blackberry devices since the first RIM 957, and typically upgrade every year or so. I’ve watched the progression from simple push email, to pushing calendars and contacts, improved attachment support and viewing, even adding the “phone feature”. For years, the Blackberry has really focused on the core Enterprise functions of secure email, contacts and calendar and, quite frankly, delivered a seamless solution that just works, is secure and fast. It is for that reason that, up to the present day, my core, mission critical device has been a Blackberry. Over the last few years, I’ve added to that various other smartphone devices that have particular strengths, including the Nokia N95 (powered by Symbian OS), various Android devices and, my current other device, the ubiquitous Apple iPhone.

My current device usage pattern sees a Blackberry as my core device for traditional functions such as email, contacts and phone and my iPhone for for the newer, media-centric use cases of web browsing, social media, testing and using applications, and so on. Far from being rare, such carrying of two mobile devices seems to be the norm amongst many early adopters. Some even call it their “guilty secret.”

My current device usage pattern sees a Blackberry as my core device for traditional functions such as email, contacts and phone and my iPhone for for the newer, media-centric use cases of web browsing, social media, testing and using applications, and so on. Far from being rare, such carrying of two mobile devices seems to be the norm amongst many early adopters. Some even call it their “guilty secret.”

Over the recent past, I’ve seen my expectations of the mobile experience dramatically escalate. In reality, the term smartphone is a bit of a misnomer as the phone function is becoming just one application among many in a complex, highly functional, personal, mobile computing device. The state of the art in converged mobile devices (smartphones and, increasingly, tablets) has indeed crossed the Rubicon. I believe that this new mobile universe is as big a break with the past for the mobile industry as was the rise of the internet (particularly the web) to the older desktop computing industry. Indeed, in several markets, 2010 is the year when smartphones outsell laptops and desktops (combined).

To summarize this new palette of capabilities of this new mobile computing generation, they fall into several areas:

To summarize this new palette of capabilities of this new mobile computing generation, they fall into several areas:

- rich web browsing experience, typically powered by WebKit technology, which ironically was pioneered by ReqWireless (acquired by Google) right here in Waterloo. With the advent of HMTL5, many such as Google, view the browser as the new applications platform for consumer and business applications,

- robust applications ecosystem, with simple AppStore function to buy, install and update. iPhone and Android are pretty solid in this regard. Blackberry’s ill fated AppWorld is an entirely different matter. For me, it was hard to find, not being on my Home Screen, application availability seemed to be (counterintuitively) dependent on the Blackberry model I was using, and also the OS memory security didn’t seem up to the applications actually working reliability. (Translation, I found that loading applications onto my Blackberry made the device slower and less reliable, so ended up removing most applications). Whatever the reasons, the iPhone AppStore has 250,000 applications with 5 billion downloads. Android Market has over 80,000 applications and Blackberry AppWorld lags signfiicantly behind this.

- user friendly multi-media interface, including viewing of web, media, and images, drop & drop and stretch & pinch capabilities. So far, touch screen technologies used in both iPhone and Android seem to have won the race against competing keyboard-only or stylus-based alternatives. Personally, I believe there are still huge opportunities to innovate interfaces optimized for small screens and mobile usage, so I will remain open to the emergence of alternative and competing technologies. I’m convinced that one use case scenario doesn’t fit all.

- a secure, modern & scalable operating system on which to build all of the above and to drive the future path of mobile computing. Given my heritage in the UNIX world starting in the 1970’s, it is interesting to me that all modern smartphones seem to be built around a UNIX/LINUX variant (iOS is derived from BSD UNIX and Android from Linux) which provides a proven, scalable and efficient platform for secure computing from mobiles to desktops to servers. Blackberry OS, by contrast, appears to be a victim of its long heritage, starting life less as a real operating system, but more a TCP/IP stack bundled with a Java framwork that morphed over time (it sounds reminiscient of the DOS to Windows migration, doesn’t it?). To be fair, Microsoft’s Windows Phone OS also suffers from its slavish attempt to emulate Windows metaphors on smaller, lower power devices and the translation doesn’t work well.

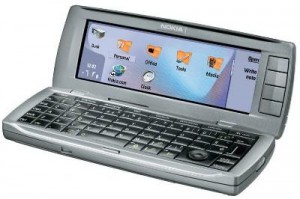

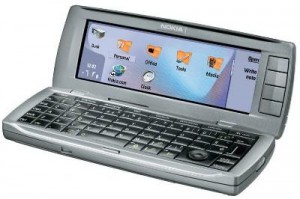

I want to stress an important point. This is not solely a criticism of Blackberry being slow to move to the next mobile generation. In fact, some of the original smartphone pioneers are struggling to adapt to this new world order as well. My first smart phone was the Nokia 9000 Communicator, similar to the device pictured on the left, and first launched in 1996. Until recently, Nokia with their Symbian OS Platform was the leader in global smartphone market share. Likewise, Microsoft adapted their Windows CE Pocket PC OS, also first released in 1996, for mobile computing market earlier in this decade, and that effort is now called Windows Phone, shown on the right. Both vendors just seem to have lost the playbook for success, but continue to thrive as businesses because smartphones represent a relatively small fraction of their overall businesses. However, respectively, feature phones and desktop OS and applications, are hardly likely to continue to be the growth drivers they once were.

I want to stress an important point. This is not solely a criticism of Blackberry being slow to move to the next mobile generation. In fact, some of the original smartphone pioneers are struggling to adapt to this new world order as well. My first smart phone was the Nokia 9000 Communicator, similar to the device pictured on the left, and first launched in 1996. Until recently, Nokia with their Symbian OS Platform was the leader in global smartphone market share. Likewise, Microsoft adapted their Windows CE Pocket PC OS, also first released in 1996, for mobile computing market earlier in this decade, and that effort is now called Windows Phone, shown on the right. Both vendors just seem to have lost the playbook for success, but continue to thrive as businesses because smartphones represent a relatively small fraction of their overall businesses. However, respectively, feature phones and desktop OS and applications, are hardly likely to continue to be the growth drivers they once were.

I need to stress another point mentioned earlier. There will be competing approaches to platform, user interface, and design. While it is possible that Android could commoditize the smartphone device market in the way that Wintel commoditized the mass PC desktop and laptop marketplace, I suspect that being ubiquitous, personal and mobile, these next generation smartphones are likely to evolve into disparate usage patterns and form factors. That said, there will be certainly be signficant OS and platform consolidation as the market matures.

At last I get to my challenge. As an avowed early adopter, I have aggressively worked at productivity in a “mobile nomadic” workstyle which leverages open interfaces, use of the cloud and many different techniques. Even I am surprised by the huge enabling effect of modern hardware, communications and applications infrastructure in the mobile realm. Essentially, very few tasks remain that I am forced back to my desktop or laptop to accomplish. However, the sad fact is that the current Blackberry devices (also Nokia/Symbian and Microsoft) fail to measure up in this new world. Hence the comment about Farms and Paris. The new mobile reality is Paris.

My challenge comes in two parts:

- What device should replace my current Blackberry?

- Since the above article doesn’t paint a very pro Blackberry picture, what is RIM doing about this huge problem?

I should point out that I have every reason to want and hope that my next device is a Blackberry. RIM is a great company and a key economic driver for Canada and I happen to live and work in the Waterloo area. Furthermore, I know from personal experience that RIM has some of the smartest and most innovative people in their various product design groups, not to mention having gazillions of dollars that could fund any development. Rather, I would direct my comments at the Boardroom and C-Suite level, as I am baffled why they have taken so long to address the above strategic challenges which have already re-written the smartphone landscape. Remember that iPhone first shipped in Janaury 2007 and the 3G version over 2 years ago, so it’s not new news. Android is a bit slower out of the gate, but has achieved real traction, particularly in the last few quarters. And, to be clear, I’m not alone in this – see “Android Sales Overtake iPhone in the US” – which goes on to show the the majority of Blackberry users plan to upgrade to something other than Blackberry. The lack of strategic response, or the huge delays to do so, remains an astonishing misstep.

Therefore, if anyone senior from RIM is reading this, please help me to come to a different conclusion. I very much would like to continue carrying Blackberry products now and into the foreseeable future.

For other readeers, please comment with your thoughts. What device would you carry, and more importantly, why?

[NOTE: this post was written a week before today’s launch of the Blackberry 9800 Torch with OS 6. There are definitely some promising things in this design, but it remains to be seen if, indeed, this device represents the quantum leap that the new marketplace reality requires]

My current device usage pattern sees a Blackberry as my core device for traditional functions such as email, contacts and phone and my iPhone for for the newer, media-centric use cases of web browsing, social media, testing and using applications, and so on. Far from being rare, such carrying of two mobile devices seems to be the norm amongst many early adopters. Some even call it their “guilty secret.”

My current device usage pattern sees a Blackberry as my core device for traditional functions such as email, contacts and phone and my iPhone for for the newer, media-centric use cases of web browsing, social media, testing and using applications, and so on. Far from being rare, such carrying of two mobile devices seems to be the norm amongst many early adopters. Some even call it their “guilty secret.”

cloud computing, driven by virtualization, in which vast arrays of commodity computing power is outsourced and interconnected with high bandwidth network connectivity wasn’t considered at all. The 1990’s ethos was company controlled, in house, server farms.

cloud computing, driven by virtualization, in which vast arrays of commodity computing power is outsourced and interconnected with high bandwidth network connectivity wasn’t considered at all. The 1990’s ethos was company controlled, in house, server farms. Web 2.0 can be viewed as many pre-bubble Web 1.0 concepts finally coming to reality in the fullness of time. Whereas there used to be much talk about “bricks” versus “clicks”, the modern company is fully integrated with the Web as a part of the distribution strategy. Companies that were simply a “web veneer”, like Webvan or Pets.com are gone and long forgotten.

Web 2.0 can be viewed as many pre-bubble Web 1.0 concepts finally coming to reality in the fullness of time. Whereas there used to be much talk about “bricks” versus “clicks”, the modern company is fully integrated with the Web as a part of the distribution strategy. Companies that were simply a “web veneer”, like Webvan or Pets.com are gone and long forgotten.

Now what? You’ll want to evolve a business model that helps viral adoption, yet still allows for effective monetization of your great new application. Below are the three main web-based models you may wish to consider:

Now what? You’ll want to evolve a business model that helps viral adoption, yet still allows for effective monetization of your great new application. Below are the three main web-based models you may wish to consider: 2. Free: Since the early days of the web, sites like Yahoo!, and more recently Google and Skype, based on web economics and culture offer a high level of service and utility for the amazingly low price of free. Free continues to be the pricing model of choice for consumer web users. Notwithstanding the lowered costs to provide such services, the old adage of “make it up in volume” doesn’t get you very far toward cash flow positive. That’s one of the key paradoxes of the web, how to balance consumer desire for free with the need to make money.

2. Free: Since the early days of the web, sites like Yahoo!, and more recently Google and Skype, based on web economics and culture offer a high level of service and utility for the amazingly low price of free. Free continues to be the pricing model of choice for consumer web users. Notwithstanding the lowered costs to provide such services, the old adage of “make it up in volume” doesn’t get you very far toward cash flow positive. That’s one of the key paradoxes of the web, how to balance consumer desire for free with the need to make money. 3. Freemium: As a hybrid of Subscription and Free, this model was first popularized in 2006 by

3. Freemium: As a hybrid of Subscription and Free, this model was first popularized in 2006 by

3 Oct 2014

0 CommentsCanadian Angel of the Year Award

At the NACO Summit in Québec City, it was truly humbling to receive the Canadian Angel of the Year Award. I see this partly as a calling to be an ambassador to continue to help raise the Angel bar in Canada in the coming years. I wish to thank all those kind colleagues who, unbeknownst to me, wrote letters of nomination. Also, this is all based on the remarkable people at GTAN and in the Waterloo and Canadian ecosystem generally.

In response to the award, and recognizing the opportunity to build on current success, I shared the following observations and future challenges at the closing Keynote on Friday 3 October, 2014.

“TODAY’S CRITICAL MASS CAN POWER A QUANTUM LEAP”

Closing Keynote NACO Summit, Québec City Friday 2 October, 2014

Bonjours, mesdames et messieurs. Good morning, ladies and Gentlemen.

I hope that Yuri was aware of what he was unleashing by inviting me to share perspectives and future challenges of Angel investing in Canada! Not unlike a startup running on “fumes”, Canada’s angel sector reminds me of the quip from cartoonist Bill Hoest: “I just need enough money to tide me over until I need more”. I’ll start by looking back to help us paint a future directional context.

As Angel investors, we’ve watched a powerful people-driven engine, coming from nowhere, to become a key enabler of Canada’s future prosperity. As Angels, we fuel innovation companies with our capital and mentorship, ultimately creating some of the highest value jobs for 21st century Canada. What’s not to like about that?

Let’s turn the clock back about 5 years. In 2009, the global economy endured the infamous credit crunch, perhaps the worst economic correction since the Great Depression. I observed this to be the final nail in the coffin for a large number of Canadian venture capital firms, for years struggling to generate viable returns. The seeming extinction of venture capital A-rounds and the bleak landscape for young, emerging companies, compelled me, as a seasoned tech investor, to get involved with the founders at Golden Triangle AngelNet (GTAN) in Waterloo-Guelph-Wellington-Stratford area. In a pattern surely repeated across Canada, Angel Groups from a slow start quietly and persistently worked to fill the funding gap through a labour-intensive “syndication” of Angel capital, with other groups and with government co-investment. In Ontario, this meant repurposing MaRS IAF from its origins as a VC on-ramp to co-investment in Angel rounds, lobbying that ultimately led to the Feddev “Investing in Business Innovation” (IBI) program, and BDC convertible notes.

A typical syndication for a top tier investee company might entail half a million dollars of Angel money being spun into $1.5 million or more. I used to describe this approach as providing “half the money of a VC A round for 10 times the effort”. At the time, I imagined this to be a strategy for a short term “bridge” of Canada’s innovation ecosystem to a more sustainable future. How did this market correction turn out for Canadian Angels?

NACO stats show a remarkable growth in total Angel investment. Between 2012 and 2013 alone, Canadian Angel group direct investments grew a stellar 120% from $40 million to $89 million. Of course, this doesn’t capture the aforementioned co-investment leverage that Angel investors attract nor does it cover investments outside of NACO members. All of us rightfully deserve to be proud of such collective impact.

But is it enough? Both from my own international investing and available statistics, it would appear that Canada’s Angel ecosystem is ahead of Europe on the maturity curve. I would estimate Canada has a 3-5 year head start on Europe. On the other hand, our American friends are definitely well ahead in maturity, deal dollars and information gathering. Angel Capital Association (ACA) data shows almost $25 billion of total US angel investment in 2013. To be at this level, on a per capita GDP basis, Canada would need about $2.8 billion of annual Angel investment. Even counting all the leverage, Canadian angel investment needs to grow 5 to 10 times over the coming years just to achieve parity with the US.

In Waterloo, home of Perimeter Institute, we tend to love Quantum Mechanics metaphors. Thus, propelling today’s critical mass through a quantum leap is a mission all of us need to work on collectively and individually, whether as angels, angel groups, NACO, governments, venture capitalists, sponsors, in fact, each and every ecosystem participant.

So, I will conclude by identifying just five of the gaps that we collectively need to fill:

With these key points in mind, and assuming the right environment, I have no doubt that greater innovation in business models will fuel growth of a larger and more sustainable Canadian angel landscape. All of us can play our part. To dial up our game, will be an aggressive, yet I believe achievable challenge. And, we need even better measurement so we can regularly monitor, and report back to ecosystem participants, our progress.

The road forward isn’t just about traditional business. Because Angel investors’ motivations uniquely straddle the ever-blurring boundary between “passion capital” and Wall Street-style finance, Angel investing will increasingly be a great exemplar of Social Innovation. To me, the culture of collegiality and sharing resembles my experiences in nation-building around charitable foundations.

The last five years have witnessed an unprecedented expansion of Canadian Angel investing and we are poised for even more remarkable growth in the next five. In the words of the incomparable Alan Turing,

“We can only see a short distance ahead, but we can see plenty there that needs to be done”.

Now, let’s get to work …