29 Oct 2012

0 CommentsTech Terroir

In the world of wine, the concept of terroir describes a centuries long process in which the climate, soil, grape varieties and dedicated vintners, symbiotically develop a unique “sense of place” for a wine region. A favourite of mine, the garrulous and quintessential Californian vintner, Randall Grahm, while trying to establish the old World notion of terroir in California postulates that it is a long term proposition and can take centuries to develop.

As both a wine lover and serial tech entrepreneur, I firmly believe that building a tech cluster is similarly a very long term process. Ironically, the epicentre of tech clusters is in California. The Silicon Valley, which got its start in the 1950s remains the major cluster worldwide as “… no other place as yet has the Valley’s scale and resilience.”

Although I started my tech startup career in the US, it was in the Canada’s leading tech cluster of Waterloo where I built major companies and was one person who got that cluster started. Like Silicon Valley’s origins in Stanford University, the Waterloo cluster was initially fuelled by University of Waterloo. Over time, a combination of executive and programming talent, capital and professional services capabilites led to the current state of almost 1000 technology companies. By contrast to Silicon Valley, Waterloo is a must younger cluster, having started just over 25 years ago compared to the 60 years of Silicon Valley. It continues to mature around some key ingredients such as global strategic marketing capabilities and sufficient capital to fund on a globally competitive basis. Experienced people may well be the most important ingredient in a cluster’s maturation.

Further, I feel that all who have been fortunate to build wealth and experience in business, owe an obligation to “pay it forward” to the next generation. My own contributions include significant startup mentoring, Board and strategic roles in organizations like Communitech and Innovation Guelph, and for the last 3 years a Board role and chairing Selection Committee for the Golden Triangle AngelNet (GTAN). In just 3 years, GTAN has grown to about 150 paid accredited investor members who bring a wealth of experience to the 25 funding transactions to date. And, it goes without saying, that many of those financings might not have happened without GTAN having emerged to fill a significant funding gap as VC’s became largely extinct. Acting as a superangel to syndicate angel network deals is a tremendously labour intensive exercise, but one that I and others believe will pay off in the long term economic prosperity of our region.

I firmly believe knowledge-based companies to be the key ingredient of our future economic prosperity, so such company-building competence is mission critical for our region, province, country and globally. As globalization occurs, we see more and more regions clambering to reap the riches of the innovative, tech startup world.

To that end, at Verdexus, we have always taken a transatlantic perspective, primarily to have a more global window on building companies that can achieve world leadership in their chosen businesses. Over the years, I’ve worked with startups across the United States and Europe in the dominant clusters such as Boston, Chicago, Silicon Valley, London, Munich, Berlin, Stockholm and more. To round out my experience, over the last few years, I’ve sampled some key emerging regions by volunteering as an expert judge in places as diverse as Brussels area, Warsaw and Torino. A week ago, I had the opportunity to judge startups associated with the European Space Agency in Toulouse France as well as in Istanbul, Turkey. The latter Istanbul venue, EU Venture Forum was jointly sponsored by EUREKA (the pan-European research and development funding and coordination organization) and Europe Unlimited from Brussels. Collectively, these more than a dozen regional events ultimately feed into a pan-European venture prize in Berlin in December.

It has been very instructive to visit various clusters. This grassroots view, from the perspective of startups, reveals much in common globally but also a few surprises. Based solely on interacting with local startups, on a global perspective, it is clear that culture and experience vary greatly across various Euroopean regions. For example, I was pleasantly surprised that Warsaw had some of the smartest and most sophisticated business startups I’d seen anywhere. And, remember, they are pitching in English which is not their native language. Conversely, the cluster around Torino appeared to have a long way to go before its startups would begin to measure up globally.

Pitching in Istanbul

Pitching in Istanbul

Similarly, the startups I saw in Istanbul were impressive. Some companies, following a model also common to the emerging markets of Central and Eastern Europe, were essentially cloning an existing business model into the 80 million strong Turkish market. More significantly others were clearly building globally strong technology startups. One pleasant surprise was that, of the eight companies that I coached the day before the forum, three had women CEOs. This was a surprise for Turkey, but sadly women-led companies remain all to rare in Canada

The calibre of engineering and basic technology talent was very impressive. That said, it was also clear that the level of support ecosystem around these startups is very limited – at least compared to what we see here in North America. One direct challenge was that in Europe companies appear to receive generous R&D funding which seems to encourage more of an engineering mentality than a market-driven one. In essence, projects stay too long as “science projects” and the culture and skills to get projects to market seem to suffer as a result. Although this is a generalization, there are many exceptions.

In the area of capital, the meltdown in Venture Capital A Round investments is about 3-4 years behind what already occurred in Canada. One particularly European challenge is that more and more of the VC funds have moved their offices and focus from regional markets to London, meaning that companies in the regions often have less direct access to capital. Conversely, the growing role of Angel Networks and Superangels to fill the gap is still in its infancy in Europe. I suspect that will change over the next two or three years. Venture funders like to either be close (1 hour travel) to their portfolio companies or, at the very least, to have a local investor who can “provide adult supervision”. Increasingly, experienced serial entrepreneurs will be called on to fill that key local role as Angels and Superangels. It is clear that the notion of Tim Draper going to Estonia and finding Skype is definitely the exception rather than the rule.

And that takes me right back to the notion of “tech terroir”. As global innovation increases, and people around the world vie to build ever stronger tech startup ecosystems, it is the dedicates entrepreneurs in the sector who magically nurture these maturing ecosystems. As one of the entrepreneurs that I coached mentioned, she wants to:

“make innovation easier in Turkey and to make life easier for entrepreneurs”

So, in addition to building a great global business, she also takes time to help move the needle of her local ecosystem forward. It’s a very encouraging sign that continues to inspire me as I engage with the new globalized world of tech startups.

Bill Gates, partly at the instigation of Warren Buffet who added his personal fortune to that of Gates, left Microsoft, the company he built, to dedicate his life to innovative solutions to large world issues such as global health and world literacy through the

Bill Gates, partly at the instigation of Warren Buffet who added his personal fortune to that of Gates, left Microsoft, the company he built, to dedicate his life to innovative solutions to large world issues such as global health and world literacy through the  Started by Paul Brainerd, Seattle-based

Started by Paul Brainerd, Seattle-based  Jeffrey Skoll, a Canadian-born billionaire living in Los Angeles and an early employee of

Jeffrey Skoll, a Canadian-born billionaire living in Los Angeles and an early employee of  Waterloo’s own Mike Lazaridis aims to transform our understanding of the universe itself by investing hundreds of millions of dollars into

Waterloo’s own Mike Lazaridis aims to transform our understanding of the universe itself by investing hundreds of millions of dollars into

(l->r) Ralph Deiterding, Eric Palmer, Ruth Songhurst, [TSX VP], Randall Howard, Tobi Moriarty, Mike Day, David Rowley

(l->r) Ralph Deiterding, Eric Palmer, Ruth Songhurst, [TSX VP], Randall Howard, Tobi Moriarty, Mike Day, David Rowley MKS Team (circa 1992) – Old Post Office, Waterloo

MKS Team (circa 1992) – Old Post Office, Waterloo

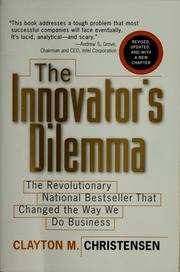

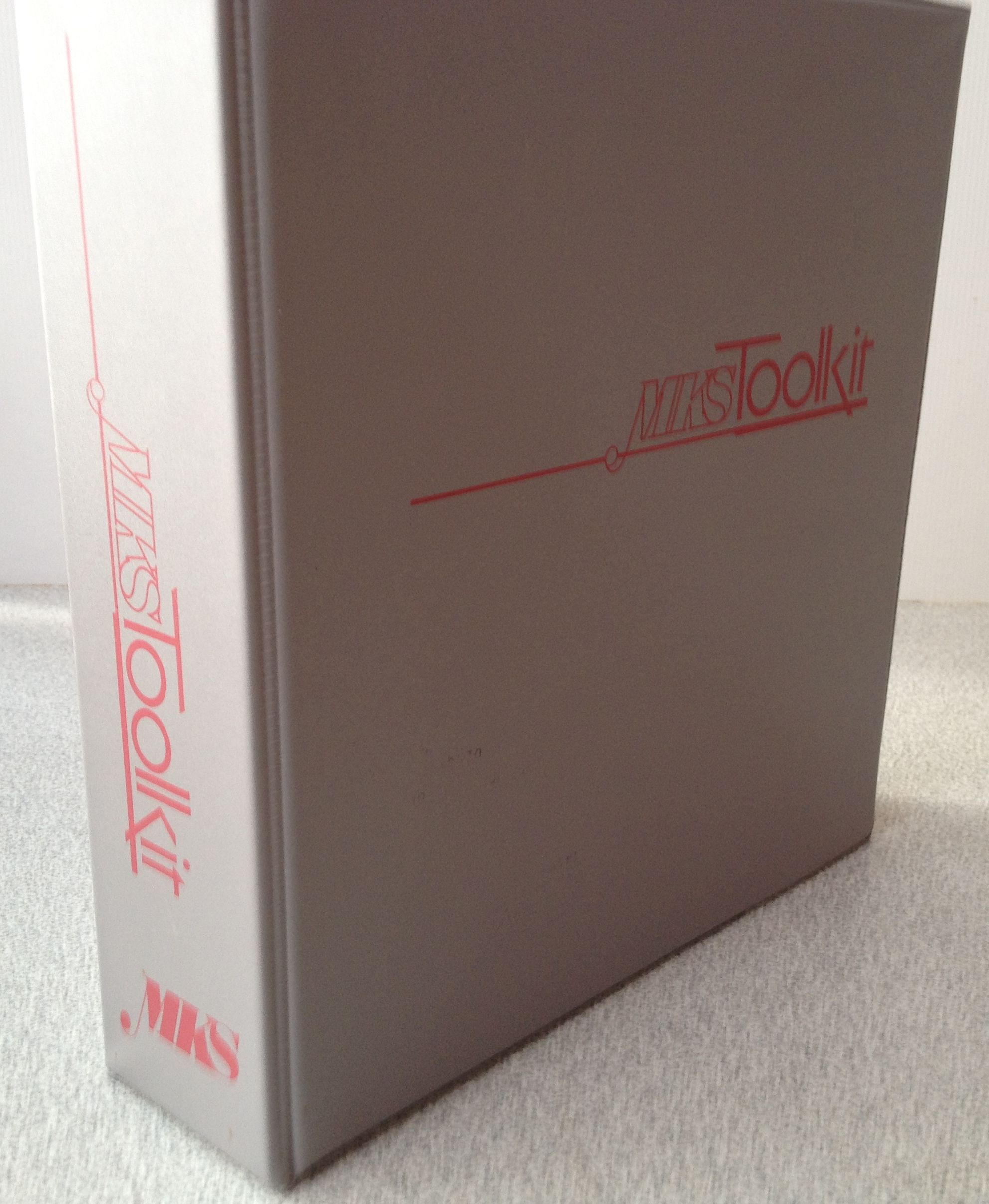

In 1984, I co-founded MKS with Alex White, Trevor Thompson, Steve Izma and later Ruth Songhurst. Although the company was supposed to build incremental desktop publishing tools, our early consulting led us into providing UNIX like tools for the fledgling IBM PC DOS operating environment (this is a charitable description of the system at the time). This led to MKS Toolkit, InterOpen and other products aimed at taking the UNIX zeitgeist mainstream. With first commercial release in 1985, this product line eventually spread to millions of users, and even continues today, surprising even me with both its longevity and reach. MKS, having endorsed POSIX and x/OPEN standards, became an open systems supplier to IBM MVS, HP MPE, Fujitsu Sure Systems, DEC VAX/VMS, Informix and SUN Microsystems.

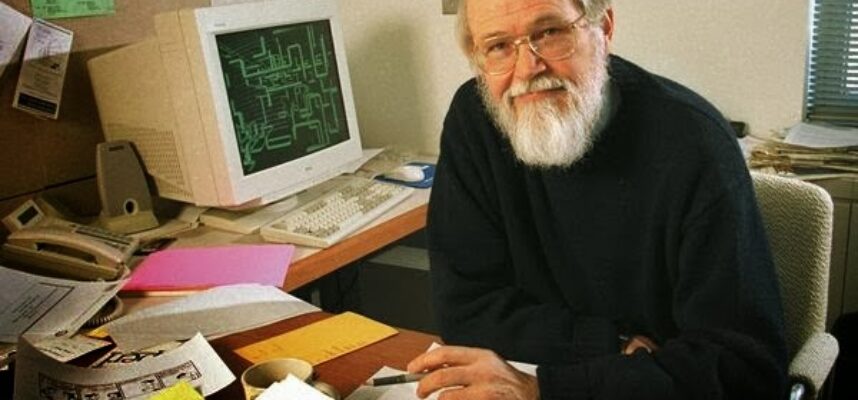

In 1984, I co-founded MKS with Alex White, Trevor Thompson, Steve Izma and later Ruth Songhurst. Although the company was supposed to build incremental desktop publishing tools, our early consulting led us into providing UNIX like tools for the fledgling IBM PC DOS operating environment (this is a charitable description of the system at the time). This led to MKS Toolkit, InterOpen and other products aimed at taking the UNIX zeitgeist mainstream. With first commercial release in 1985, this product line eventually spread to millions of users, and even continues today, surprising even me with both its longevity and reach. MKS, having endorsed POSIX and x/OPEN standards, became an open systems supplier to IBM MVS, HP MPE, Fujitsu Sure Systems, DEC VAX/VMS, Informix and SUN Microsystems. During my later years at MKS, as the CEO, I was mainly business focussed and, hence, I tried to hide my “inner geek”. More recently, coincidentally as geekdom has progressed to a cooler and more important sense of ubiquity, I’ve “outed” my latent geek credentials. Perhaps it was because of this, that I rarely thought about UNIX and the influence that talented Bell Labs team, including Dennis Ritchie, had on my life and career. Now in the second decade of the 21st century, the world of computing has moved on to mobile, cloud, Web 2.0 and Enterprise 2.0. In the 1980’s, after repeated missed expectations that this would (at last) be the “Year of UNIX” we all became resigned to the total dominance of Windows. It was, in my view, a fatally flawed platform with poor architecture, performance and security, yet Windows seemed to meet the needs of the market at the time. After decades of suffering through the “three finger salute” (Ctrl-ALT-DEL) and waiting endlessly for that hourglass (now a spinning circle – such is progress), in the irony of ironies UNIX appears on course to win the battle for market dominance. With all its variants (including Linux, BSD and QNX), UNIX now powers most of the important Mobile and other platforms such as MacOS, Android, iOS (iPhone, iPad, iPod) and even Blackberry Playbook and BB10. Behind the scenes, UNIX largely forms the architecture and infrastructure of the modern web, cloud computing and also all of Google. I’m sure, in his modest and unassuming way, Dennis would be pleased to witness such an outcome to his pioneering work.

During my later years at MKS, as the CEO, I was mainly business focussed and, hence, I tried to hide my “inner geek”. More recently, coincidentally as geekdom has progressed to a cooler and more important sense of ubiquity, I’ve “outed” my latent geek credentials. Perhaps it was because of this, that I rarely thought about UNIX and the influence that talented Bell Labs team, including Dennis Ritchie, had on my life and career. Now in the second decade of the 21st century, the world of computing has moved on to mobile, cloud, Web 2.0 and Enterprise 2.0. In the 1980’s, after repeated missed expectations that this would (at last) be the “Year of UNIX” we all became resigned to the total dominance of Windows. It was, in my view, a fatally flawed platform with poor architecture, performance and security, yet Windows seemed to meet the needs of the market at the time. After decades of suffering through the “three finger salute” (Ctrl-ALT-DEL) and waiting endlessly for that hourglass (now a spinning circle – such is progress), in the irony of ironies UNIX appears on course to win the battle for market dominance. With all its variants (including Linux, BSD and QNX), UNIX now powers most of the important Mobile and other platforms such as MacOS, Android, iOS (iPhone, iPad, iPod) and even Blackberry Playbook and BB10. Behind the scenes, UNIX largely forms the architecture and infrastructure of the modern web, cloud computing and also all of Google. I’m sure, in his modest and unassuming way, Dennis would be pleased to witness such an outcome to his pioneering work.

Credit: AIAlex.com

Credit: AIAlex.com Unlike this sign, I don’t want to end this piece on a note of doom and gloom. Nor do I want to leave the impression that there aren’t very talented people in the Canadian VC industry. Nothing could be further from the truth – our long term VC gap arises from long term structural challenges, such as a lack of discipline as imposed by global LPs and not having reached the proper banker/operator mix. There are other factors, including the small population and large geography unique to Canada, but all can be and should be overcome with the proper model.

Unlike this sign, I don’t want to end this piece on a note of doom and gloom. Nor do I want to leave the impression that there aren’t very talented people in the Canadian VC industry. Nothing could be further from the truth – our long term VC gap arises from long term structural challenges, such as a lack of discipline as imposed by global LPs and not having reached the proper banker/operator mix. There are other factors, including the small population and large geography unique to Canada, but all can be and should be overcome with the proper model.

14 Jan 2014

0 CommentsThe Group of Seven – Nation Building for the 21st Century

Last year, I signed up for a wonderfully ambitious initiative spearheaded by our Governor General, His Excellency David Johnston. I was invited to join a Group of Seven who will serve as catalysts to rolling out David Johnson’s vision of a Smart and Caring Nation built by a set of Smart and Caring Communities, ultimately aimed to be a major national initiative to commemorate Canada’s 150th birthday, or sesquicentennial, in 2017.

I was very much honoured to be asked and, although it is a dauntingly large not to mention a somewhat unspecified, goal, as a proud Canadian who knows first hand David Johnston’s unique ability to lead and motivate, I quickly agreed to this call. I’ll share more about this initiative in order to seek your input. Since no small group can be representative of our huge and diverse nation, it is important the we engage in much dialogue from Canadians of all ages and demographic profile, in order to achieve maximum impact and relevance.

As a way to start that conversation, I’d like to share some of my perspectives on Smart and Caring 2017.

David Johnston’s Smart and Caring Vision:

This whole project starts with a great foundation in our Governor General’s Smart and Caring vision for Canada. And here is why his singular leadership is so critical to this initiative.

David Johnston has a long track record of motivation. Back in 2006, as President of Unviersity of Waterloo, he challenged the already ambitious and successful business, community and government leaders in Waterloo Region to reach even higher. Issued in November 2006, his Ten Goals to Make Waterloo Region Canada’s Knowledge Capital are a blueprint that inspired and motivated real change and continue to have an impact today.

Similarly, on 1 October 2010 at his installation speech as Governor General in the Senate Chambers in Ottawa, David Johnston laid out his vision for nation building in Canada, challenging us to build a Smart and Caring Nation:

To build on that vision as we near the sesquicentennial of Canada as a country in 2017, His Excellency has challenged Community Foundations of Canada and the growing network of 191 grass roots Community Foundations across our country. He wants them to lead a groundswell movement, in each and every community and nationally, for Smart and Caring 2017.

Canada – A History of Evolutionary Nation Building:

With that vision as inspiration, and as a passionately proud Canadian, here is my perspective on Canada as a nation. We were not formed by revolution, as is the case in many other countries like the USA or France. True to our character, our particular style of nation-hood opted instead for evolution at a slow almost glacial pace. You might almost say that Canada pioneered nation building by committee. Specifically, a series of meetings commencing with the Charlottetown Conference, 150 years ago in 1864, led to Confederation on 1 July 1867.

I would argue that, as a nation, we were more defined by what we were not — ie. no tea parties or revolutions to overthrow a king. Instead, via peaceful change we enjoyed a tabula rasa upon which to architect a unique nation in those lands north of the growing United States of America. The process was slow. We remained essentially a colony with large parts of the country feeling more British than Canadian for many years. Consider how long it took us to have a non-British Governor General (Vincent Massey, 1952), our own flag (1965, replacing the Union Jack) or our own constitution (repatriated from Westminster in 1982).

Until the late 20th century, innumerable British colonial vestiges remained. Many people argue that Canadian heroism and sacrifices for the motherland in World War I, just 100 years ago, started the modern trend of a strengthening Canadian identity both internally and as a nation on the global stage.

Canada’s Centennial in 1967 marked a major inflection point for Canada. We had come through two world wars with a strong sense of national identity, supported by the burgeoning post war economy. Canada proudly led on the world stage with the likes UN Peacekeeping, Expo ’67 in Montréal and the uber cool federalist Prime Minister Pierre Elliot Trudeau.

Set right in the middle of the swinging 1960’s, our centennial celebrations in 1967 were a wonderful time to be alive. Besides Expo ’67 and the quaint historical “centennial” costumes people wore, today we are left with innumerable Centennial arenas, parkways, libraries, etc. These major investments in infrastructure are present with us today. I recall that time with pride and fondness.

CFC Smart and Caring Project:

Because the 21st Century seems so different than the previous, what kind of movement should honour Canada’s 150th birthday. It is a complex question, but I believe that if we can mobilize almost all communities across Canada into activities and projects inspired by the “Smart and Caring” mantra, like a national pot luck dinner we would effectively crowdsource some of national, and even, international significance.

Once again, we have a unique opportunity to make positive changes while setting a positive example for the world.

It is important to understand that, because each and every community is unique, communities must have the freedom to launch initiatives that directly suits their unique needs. Nonetheless, with diverse initiatives considered collectively, I believe that, taken as a whole we can shape and inspire the Canada of the future. We have so many advantages and the time is right to embark of nation building for the 21st century.

I would further hope that we would see collective action and partnership, both at the community level and national level, to increase the impact and effectiveness of the Smart and Caring 2017 initiatives. We must speak to and be meaningful to all Canadians:

Because no group, no matter how large, can be sufficiently inclusive, that is why it is absolutely imperative that we, who have been honoured to help make this happen, hear from as many Canadians as possible.

Please weigh in here with comments or find other ways to get involved. And, I hope to provide more updates and opportunities to engage, participate, shape and drive Canada’s 150th birthday celebrations – Smart and Caring 2017.Please start by sharing your thoughts on what Smart and Caring 2017 means to you.