5 Jan 2012

0 CommentsPost-acquisition Reflections on MKS

First of all, I would like to congratulate Phil Deck, Michael Harris and the entire team for finding both a fabulous new home for MKS, but also one which represents a significant strategic financial transaction, valuing MKS at just over 4 times estimated FY2011 sales.

Many people have asked for my perspective. In short, I continue to view the acquisition as favourable to customers, employees, Waterloo and its shareholders. To delve further, this article, written from my own perspective, gives both background and some lasting observations and universal lessons from MKS.

Over the last decade, MKS largely sat out the wave of consolidations in Applications Lifecycle Management (ALM, that builds on the earlier category of Software Configuration Management), for example:

- IBM acquiring Rational Software for $2.1 billion on 6 December, 2002,

- Mercury Interactive acquiring Kintana for $225 million on 10 December, 2003,

- Serena Software acquiring Merant on 3 March, 2004 for $380 million, followed by

- Silver Lake Partners, a private equity firm, acquiring Serena Software for $1.2 billion on 11 November, 2005,

- IBM acquiring Telelogic (which had earlier bought MKS competitor Continuus Software) for $745 million during April 2008

The aforementioned almost $5 billion acquisition binge represented a huge shift in the ALM market dynamics. By 2011, a new driver for acquisitions had emerged. As engineered products start to contain more software value than traditional hardware, customers requirements in the Product Lifecycle Management space started to converge with the Application Lifecycle Management space. This blending and merging of categories, fuelled by the trend to software being the dominant product differentiator, led to the acquisition of MKS by PTC and may portend more activity as these spaces continue to consolidate. Because PTC is moving into a new, but adjacent market category, that means that the domain expertise from the MKS product teams will be critical to PTC‘s long term success.

Could MKS have remained independent? My sense is, in the longer term, no. In the 1990s, a company could IPO on the NASDAQ at around $20 million revenues. Today, that number is over $100 million, and MKS at acquisition had about $75 million revenues. Perhaps further acquisitions might have accelerated getting to scale, but without a NASDAQ public currency that would have been difficult. Therefore, that’s a key reason why the PTC acquisition is such a home run win for MKS.

MKS built great value as a significant global software business over its 27 years of pre-acquisition existence. I’m very pleased that, unlike some early stage start up acquisitions, this likely means that PTC will continue to see Waterloo as a base for further expansion based around the solid product R&D team. In that sense, it’s great news for the region’s economy and something I’m very happy to see.

I wanted to reflect on a few themes that I’ve seen play out over MKS‘ long history – both lessons learned and some principles that might help some of the current crop of start ups grow into global businesses headquartered in Waterloo.

PIVOTS

MKS definitely was a company that had the proverbial “9 lives”. Using the au courant start up lingo, these were critical “pivots”. The number of pivots arises partly because MKS was a multi-product company and even more so because MKS was a first generation of software company in Canada, before clear rules to build such a knowledge based business had been formulated. Achieving company growth means many battles fought (and not all successfully) to win the war of business success. I’ve also come to learn that timing can trump even the most gifted product strategy work or execution attempts. As a result, ultimate success can be seasoned by many failures along the way to that success.

The following summarizes some of those 9 lives inside MKS:

- The original name of MKS Inc. was Mortice Kern Systems Inc. – not taken, as often supposed from an aging and curmudgeonly New York accountant, but rather inspired by two typesetting terms that connote a sort of Zen in the ancient arta of hot lead typesetting. The pre-incorporation business plan for MKS to be the first to develop and commercialize the then state of the art, full page desktop publishing. When the US technique seeking venture capital to fund this exposed that venture capital hadn’t yet begun in Canada, the company moved on to a bootstrap mode (which is oddly similar to the state of many startups and financing today).

- As mentioned, to have the resources to develop products, we put out a shingle to do contract development work for such major companies as Imperial Oil, Westinghouse, Ontario Ministry of Education and Commodore. Using a portion of the millions of revenues this generated, and with learnings from development and cross-development on the naked IBM PC and MS-DOS, we started to create our first product.

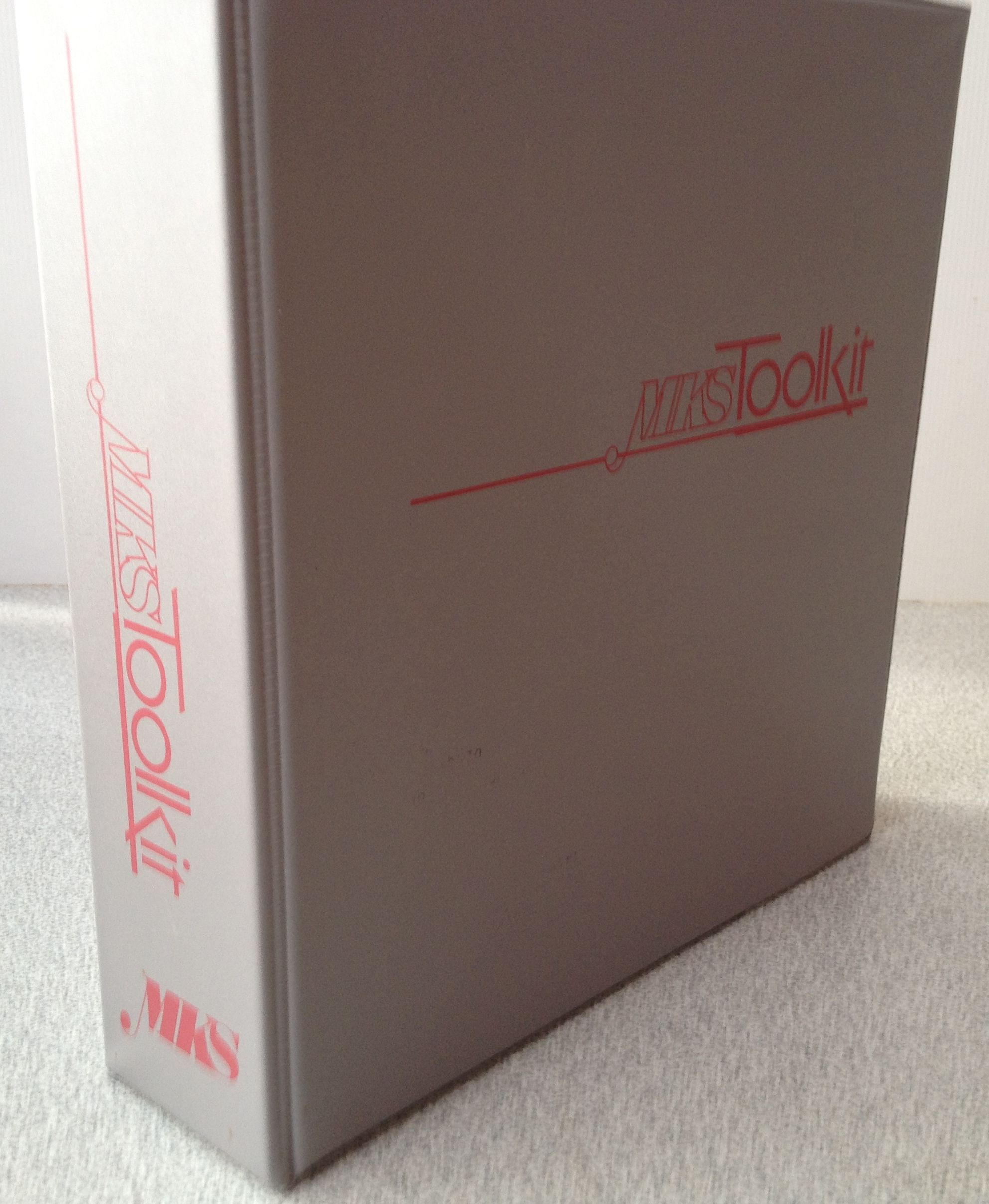

- MKS Toolkit was, as mentioned, directly inspired by a gap in the market, and by 1985 was shipping its first products. MKS Toolkit thrives, in morphed form, to this day, and more important has spawned many of the later product directions over the next 25 years.

- InterOpen emerged from my recognition that POSIX (and later x/OPEN) was being cast as Federal Information Processing Standards (FIPS, from National Institute of Standards and Technology) that meant that all existing, non-UNIX systems (we called them proprietary back then) must adopt POSIX compliant interfaces and tools. InterOpen ultimately, over many years, generated $50 million or more of OEM licensing revenues for MKS. InterOpen technology instrumental in IBM Open Edition MVS, HP MPE/ix, DEC VAX/VMS, Fujitsu SureSystem and many others.

- By 1988, we had taken an add-0n to MKS Toolkit, and named it MKS RCS which was the first generation software management system product, built around revision (version) control for software development projects.

- In 1992, another tool arising from MKS Toolkit (uucp), along with an innovation proposal from Dale Gass, led to the creation of MKS Internet Anywhere. Prior to Windows 95, with no TCP/IP stack or internet functionality, this was a consumer-grade suite bundling everything from browser, FTP, email client with the necessary stack for the market. With the battle by Microsoft to kill Netscape still in the future, this division along with a dozen including some of our most talented staff, was sold off to Open Text Corporation in 1994.

- By 1993, MKS had re-built from scratch the original MKS RCS into its first enterprise-grade product – a suite now branded as MKS Source Integrity. From then on, this was the highest growth key focus for the company, although it took some time to be profitable, being cross-subsidized by the high margin successes of MKS Toolkit and InterOpen.

- By 1995, another key MKS employee, David Rowley, drove the creation of MKS Web Integrity, which I believe to be the first ever enterprise web content management system. Although licensed into the Netscape SuiteSpot Server, along with Informix datablades and Verity search technology, perhaps the focus (and Venture Capital financing) of a pure play strategy might have given it more ammunition against early competitors like Interwoven and Vignette.

- Eventually, the need to clearly position the enterprise software management products as the sole focus of the company, and to distance from some confusion with the tools and developer-based MKS Toolkit product line, an attempt was made to separate and brand as Vertical Sky. Whether or not this might have worked at a different time, the Dot Com meltdown of 2000 meant that it was impossible to raise investment to finance such a roll out. Ultimately, Phil Deck and the new management did continue the separation and promotion of MKS Source Integrity to full enterprise grade, but without the added costs of the Vertical Sky rebranding.

Although there were many more than the above sample 9 lives, I think that the twists and turns to build a real business are a critical lesson for today’s companies. At Verdexus we today ascribe to the pure play strategy for startups (less capital required, more focus and easier to explain to investors). Nonetheless, there is much to be said for building a strong base around multiple product innovation.

WORLD CLASS TEAM

While the players have changed over the years, MKS has been blessed by an amazing group of employees, and not just in senior management. For example, at the time of our proposed NASDAQ IPO in early 1997, the investment bankers from Hambrecht & Quist in San Francisco mentioned, upon meeting our senior team, that this was amongst the strongest they have ever seen. Part of this came from hiring both from US and Canada (See GLOBAL APPROACH below) and that includes non-Canadian executives such as Tobi Moriarty, Mike Day, Holger Schmeidefeldt and Frank Schröder. We really did take to heart the maxim that great leadership came from a strong team, as I discussed in “The Power of Two (Or Three)“.

A positive environment led to better gender balance and better results. For example, in 1996 the senior management team of 7, included 3 women. Such a balance, sadly rare even today, led to enhanced results and sense of opportunity across the entire staff.

(l->r) Ralph Deiterding, Eric Palmer, Ruth Songhurst, [TSX VP], Randall Howard, Tobi Moriarty, Mike Day, David Rowley

(l->r) Ralph Deiterding, Eric Palmer, Ruth Songhurst, [TSX VP], Randall Howard, Tobi Moriarty, Mike Day, David Rowley

I am most pleased by the many talented employees at MKS, from co-op students onwards, who have gone on to incredible heights of achievement. I am continually discovering another company that has been built by talent that got its first state of the software business at MKS. I think one approach that has real merit, was the notion to bring top global talent into the business, in part for the mentoring effect this has on other employees. Considering the Waterloo ecosystem in the 1990s, this was particularly helpful in building previously thin functional areas such as marketing and product management.

MKS Team (circa 1992) – Old Post Office, Waterloo

MKS Team (circa 1992) – Old Post Office, Waterloo

Finally, given recent media attention to weak and/or non-independent boards, I was pleased to have a board that was both global and always able to hold management accountable. As CEO, I can remember many uncomfortable moments when I, or other management team members, were seriously challenged, and that is exactly how it should be.

GLOBAL APPROACH

Perhaps because I had my first software start up experience in the US (building Coherent), it only seemed natural to focus on the entire North American market, and ignore conventional advice to start with the local region, province or country. Even in the very earliest days of MKS Toolkit, when products were shipped by mail and advertised in physical magazines, we realized that every promotional dollar went much farther in the US versus just focusing on Canada. The led to perhaps the first customer of MKS Toolkit being AT&T Bell Labs, which I believe contributed to MKS becoming known across North America in developer circles. The use of 800 toll free numbers across US and Canada, coupled with email, allowed us to work and act like a US company. To me, it always felt similar to the Israeli model for tech companies.

By the 1990s, although we had distributors in Europe (and a small few in Asia), we decided invest heavily in the European market, first from a beachhead in Germany and then the UK. By 2000, Europe represented about 35% of the company’s revenues which later proved a strong hedge to the US-centric meltdown that started in 2000.

CAPITAL

Although MKS pre-dated Canadian venture capital, it did access the capital markets through various vehicles, such as the Special Warrant and IPO, that were common in the 1990s. During my tenure, about $40 million was raised, and I believe that the whole lifecycle raise was in excess of $50 million. During the 1990s, this was the normal cost to build a major entrprise software company to full scale. Today, while our Venture 2.0 methodology and the Lean Startup approach lessens the capital requirements, I still believe that, over the longer term, building a significant business takes much more capital than people realize.

One consequence of this, coupled with the more limited capital available in Canada (at least Ontario), is the tendency of technology companies to exit early – when they are partly built start ups rather than full businesses. In a way, this means that acquiring companies are really only getting a product and development team in a form of outsourced innovation. The downside of this model would seem to me to be the creation and maintenance of far fewer jobs in our region. I would love to see a rigorous study of this effect. In fact, my next post will explore the stage and timing of significant Waterloo region technology company acquisitions.

GROWTH BY ACQUISITIONS

Although MKS never had the NASDAQ public currency, being public on the TSX enabled the 7 acquisitions I was involved in. I would say that acquiring companies was a real learning curve. On balance, we managed to increase our acquisition capabilities over time, but always the results took longer than expected. For example, the acquisition of the AS/400 business from Silvon brought MKS many of today’s largest customers (e.g. HSBC), but the anticipated synergies took 2-3 years or more rather than the predicted 18 months to materialize.

The bigger issue, beyond building M&A expertise, is that today it is harder for companies to go public and have market liquidity for acquisitions than in the 1990s. I’m not sure if 21st century capital markets will ever return to a state where that is again possible.

FUN AND CAMARADERIE

Last, but definitely not least, most days whether travelling to engage the world or back in the office, people had a lot of fun while building a great business. The right mix of “work hard, play hard” can lead to a better overall experience that, in so many ways, enhances overall performance. And, we had some pretty great parties, whether at product launches in California or Europe or simply back home celebrating key milestones for MKS.

SUMMARY

The above observations represent but a small taste of my thoughts regarding the recent MKS acquisition. My hope is that the Waterloo tech ecosystem will witness many more companies being able to transcend the start up phase to become globally leading businesses. The future of our country and region depends on it.

In 1984, I co-founded MKS with Alex White, Trevor Thompson, Steve Izma and later Ruth Songhurst. Although the company was supposed to build incremental desktop publishing tools, our early consulting led us into providing UNIX like tools for the fledgling IBM PC DOS operating environment (this is a charitable description of the system at the time). This led to MKS Toolkit, InterOpen and other products aimed at taking the UNIX zeitgeist mainstream. With first commercial release in 1985, this product line eventually spread to millions of users, and even continues today, surprising even me with both its longevity and reach. MKS, having endorsed POSIX and x/OPEN standards, became an open systems supplier to IBM MVS, HP MPE, Fujitsu Sure Systems, DEC VAX/VMS, Informix and SUN Microsystems.

In 1984, I co-founded MKS with Alex White, Trevor Thompson, Steve Izma and later Ruth Songhurst. Although the company was supposed to build incremental desktop publishing tools, our early consulting led us into providing UNIX like tools for the fledgling IBM PC DOS operating environment (this is a charitable description of the system at the time). This led to MKS Toolkit, InterOpen and other products aimed at taking the UNIX zeitgeist mainstream. With first commercial release in 1985, this product line eventually spread to millions of users, and even continues today, surprising even me with both its longevity and reach. MKS, having endorsed POSIX and x/OPEN standards, became an open systems supplier to IBM MVS, HP MPE, Fujitsu Sure Systems, DEC VAX/VMS, Informix and SUN Microsystems. During my later years at MKS, as the CEO, I was mainly business focussed and, hence, I tried to hide my “inner geek”. More recently, coincidentally as geekdom has progressed to a cooler and more important sense of ubiquity, I’ve “outed” my latent geek credentials. Perhaps it was because of this, that I rarely thought about UNIX and the influence that talented Bell Labs team, including Dennis Ritchie, had on my life and career. Now in the second decade of the 21st century, the world of computing has moved on to mobile, cloud, Web 2.0 and Enterprise 2.0. In the 1980’s, after repeated missed expectations that this would (at last) be the “Year of UNIX” we all became resigned to the total dominance of Windows. It was, in my view, a fatally flawed platform with poor architecture, performance and security, yet Windows seemed to meet the needs of the market at the time. After decades of suffering through the “three finger salute” (Ctrl-ALT-DEL) and waiting endlessly for that hourglass (now a spinning circle – such is progress), in the irony of ironies UNIX appears on course to win the battle for market dominance. With all its variants (including Linux, BSD and QNX), UNIX now powers most of the important Mobile and other platforms such as MacOS, Android, iOS (iPhone, iPad, iPod) and even Blackberry Playbook and BB10. Behind the scenes, UNIX largely forms the architecture and infrastructure of the modern web, cloud computing and also all of Google. I’m sure, in his modest and unassuming way, Dennis would be pleased to witness such an outcome to his pioneering work.

During my later years at MKS, as the CEO, I was mainly business focussed and, hence, I tried to hide my “inner geek”. More recently, coincidentally as geekdom has progressed to a cooler and more important sense of ubiquity, I’ve “outed” my latent geek credentials. Perhaps it was because of this, that I rarely thought about UNIX and the influence that talented Bell Labs team, including Dennis Ritchie, had on my life and career. Now in the second decade of the 21st century, the world of computing has moved on to mobile, cloud, Web 2.0 and Enterprise 2.0. In the 1980’s, after repeated missed expectations that this would (at last) be the “Year of UNIX” we all became resigned to the total dominance of Windows. It was, in my view, a fatally flawed platform with poor architecture, performance and security, yet Windows seemed to meet the needs of the market at the time. After decades of suffering through the “three finger salute” (Ctrl-ALT-DEL) and waiting endlessly for that hourglass (now a spinning circle – such is progress), in the irony of ironies UNIX appears on course to win the battle for market dominance. With all its variants (including Linux, BSD and QNX), UNIX now powers most of the important Mobile and other platforms such as MacOS, Android, iOS (iPhone, iPad, iPod) and even Blackberry Playbook and BB10. Behind the scenes, UNIX largely forms the architecture and infrastructure of the modern web, cloud computing and also all of Google. I’m sure, in his modest and unassuming way, Dennis would be pleased to witness such an outcome to his pioneering work.

My current device usage pattern sees a Blackberry as my core device for traditional functions such as email, contacts and phone and my iPhone for for the newer, media-centric use cases of web browsing, social media, testing and using applications, and so on. Far from being rare, such carrying of two mobile devices seems to be the norm amongst many early adopters. Some even call it their “guilty secret.”

My current device usage pattern sees a Blackberry as my core device for traditional functions such as email, contacts and phone and my iPhone for for the newer, media-centric use cases of web browsing, social media, testing and using applications, and so on. Far from being rare, such carrying of two mobile devices seems to be the norm amongst many early adopters. Some even call it their “guilty secret.”

cloud computing, driven by virtualization, in which vast arrays of commodity computing power is outsourced and interconnected with high bandwidth network connectivity wasn’t considered at all. The 1990’s ethos was company controlled, in house, server farms.

cloud computing, driven by virtualization, in which vast arrays of commodity computing power is outsourced and interconnected with high bandwidth network connectivity wasn’t considered at all. The 1990’s ethos was company controlled, in house, server farms. Web 2.0 can be viewed as many pre-bubble Web 1.0 concepts finally coming to reality in the fullness of time. Whereas there used to be much talk about “bricks” versus “clicks”, the modern company is fully integrated with the Web as a part of the distribution strategy. Companies that were simply a “web veneer”, like Webvan or Pets.com are gone and long forgotten.

Web 2.0 can be viewed as many pre-bubble Web 1.0 concepts finally coming to reality in the fullness of time. Whereas there used to be much talk about “bricks” versus “clicks”, the modern company is fully integrated with the Web as a part of the distribution strategy. Companies that were simply a “web veneer”, like Webvan or Pets.com are gone and long forgotten.

Credit: Kirke Gethsemane

Credit: Kirke Gethsemane At Freidrichstrasse, there was an hour and one-half wait with mobs of people from Poland, Hungray, Czechoslavakia and East Germany returning from an excursion to West Berlin, most possibly for the first time in their lives. I was surprised, and perhaps a bit amused, to notice the most popular item being carefully carried back home across the Berlin Wall. Was it American Levi Jeans? Was it Marlboro cigarettes? None of that.

At Freidrichstrasse, there was an hour and one-half wait with mobs of people from Poland, Hungray, Czechoslavakia and East Germany returning from an excursion to West Berlin, most possibly for the first time in their lives. I was surprised, and perhaps a bit amused, to notice the most popular item being carefully carried back home across the Berlin Wall. Was it American Levi Jeans? Was it Marlboro cigarettes? None of that. After the banana incident, I finally was face to face with the East German Border Police (Deutsche Grenzpolizei) who checked my Canadian passport. Imagine a door behind you and in front of you, both electrically locked to prevent your movement. The guard looked at my passport and me, without smiling, for what must have been two minutes.

After the banana incident, I finally was face to face with the East German Border Police (Deutsche Grenzpolizei) who checked my Canadian passport. Imagine a door behind you and in front of you, both electrically locked to prevent your movement. The guard looked at my passport and me, without smiling, for what must have been two minutes.

3 Apr 2012

0 CommentsSocial Innovation – Can Social Sector Learn from Tech Startups?

It is notable that much of the recent trend towards Social Innovation has come from people who began their careers in technology startups, in Silicon Valley or other technology clusters. Some notable examples include:

Whether or not always attributtable to this connection with technology entrepreneurs, increasingly Social Sector organizations are starting to become much more like the entrepreneurial startups so familiar in the world of high technology. I’ve personally witnessed some of this change, and would like to suggest, that while there remain big differences, the parallels are strengthening over time. The following concepts represent just a small sampling of the key areas of similarity:

1. Founders Versus Artists

Stories are legion of smart, brash (and even mercurial) technology company founders who transform a business sector through the sheer strength of their wills. Many of these founders are “control freaks” and might find employment in conventional jobs a difficult proposition. Venture capital and angel investors have learned to be wary of such founders, citing numerous examples of founderitis – in which uncoachable founders, in a case of “my way or the highway” would rather maintain control than bend to ideas from often more experienced mentors, board members and investors.

Such personalities also exist in the Social Sector. For example, many arts organizations are founded by bright and innovative artistic directors. And yet, many of these same organizations come unravelled by the same mercurial nature that prevents the organization from being properly governed and accountable to funders (investors). With my background on both sides of this divide, the parallels are hauntingly striking.

Since such founders strengths can also be their undoing (or that of their organization), a conscious Board level assessment of such situations is always wise.

2. Running on Empty

Notwithstanding the media coverage of a few lucky technology startups such as Facebook or Google, most technology startups run of little or no significant funding. Many seek to change the world with very small amounts of capital, sometimes no more than several million dollars. The recent trend towards building such small capitalization organizations is called the Lean Startup movement. The challenges inherent in their undercapitalization is often the top complaint of such startups. However, Sergy Brin, the Google co-founder has insightfully observed that “constraints breed creativity” to describe how an underfunded state has led to the discovery of innovative ways to build companies and deliver their products.

Likewise, from my experience the vast majority of charities and nonprofits complain about being undercapitalized, and the reality is that most are. It is a fact of life in the social sector. Only now are we starting to see the emergence of social ventures, which by stealing a page from underfunded technology startups are exploring new business models and ways to deliver social change, often leveraging IT or a different process to vastly reduce costs of program delivery.

3. Technology Changes Everything

We’ve seen the emergence of a world where all information is stored in digital form and people are connected, even while mobile, the role of the web and technology can’t be underestimated. Technology-based startups, because they are small and start from scratch, often approach traditional problems in very non-traditional ways. Revenue and funding models change, as do fundamental ways to organize a business or social enterprise. Social media allows ideas to spread in a viral fashion. We have already seen how organizations like Avaaz can mobilize hundreds of thousands or even millions of supporters globally for both local and international issues of social injustices and poverty. This is a direct analogue to how many people now rely on Twitter or Facebook, rather than a printed newspaper, for much of their news and information.

4. Mission Creep – or the path forward

Technology startups have come to learn that success depends on laser sharp focus, attention to detail and execution of a “pure play” strategy (ie. only do one thing well). Thatparticular discipline has time and time again proven to be effective in a sector where technology change is moving rapidly and most startups are generally considered to be underfunded.

Likewise, Social Enterprises must adopt similar approaches to deal with underfunding and change. Even in today’s more fluid and fast-changing environment, to avoid deadly Mission Creep, Board and management must have developed a complete Theory of Change roadmap to enable Manage to Outcomes.