It is notable that much of the recent trend towards Social Innovation has come from people who began their careers in technology startups, in Silicon Valley or other technology clusters. Some notable examples include:

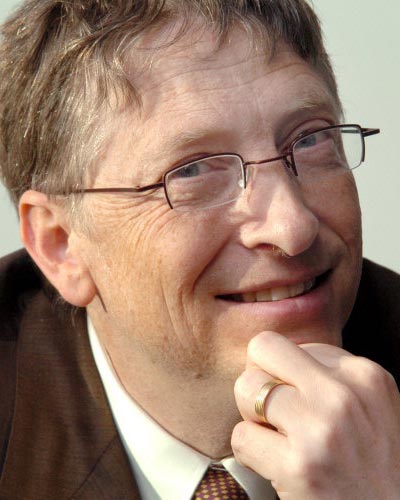

Bill Gates, partly at the instigation of Warren Buffet who added his personal fortune to that of Gates, left Microsoft, the company he built, to dedicate his life to innovative solutions to large world issues such as global health and world literacy through the Bill and Melinda Gates Foundation

Bill Gates, partly at the instigation of Warren Buffet who added his personal fortune to that of Gates, left Microsoft, the company he built, to dedicate his life to innovative solutions to large world issues such as global health and world literacy through the Bill and Melinda Gates Foundation

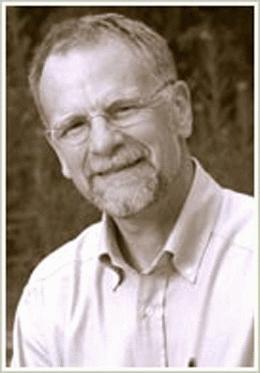

Started by Paul Brainerd, Seattle-based Social Venture Partners International is innovating at the intersection of technology and venture capital, with Venture Philanthropy. Paul sold Aldus Corporation (an innovator in desktop publishing applications, including Pagemaker) to Adobe in the mid 1990s. In his mid-40’s at the time of the Adobe acquisition, he was young enough to seek a significant and active social purpose in his life.

Started by Paul Brainerd, Seattle-based Social Venture Partners International is innovating at the intersection of technology and venture capital, with Venture Philanthropy. Paul sold Aldus Corporation (an innovator in desktop publishing applications, including Pagemaker) to Adobe in the mid 1990s. In his mid-40’s at the time of the Adobe acquisition, he was young enough to seek a significant and active social purpose in his life.

Jeffrey Skoll, a Canadian-born billionaire living in Los Angeles and an early employee of eBay, has numerous activities aimed at Social Innovation including Skoll Foundation, Skoll World Forum on Social Entrepreneurship and Skoll Award for Social Entrepreneurship. Most of his initiatives are aimed at empowering the individual Social Entrepreneurs who are fuelling a new generation of Social Innovation.

Jeffrey Skoll, a Canadian-born billionaire living in Los Angeles and an early employee of eBay, has numerous activities aimed at Social Innovation including Skoll Foundation, Skoll World Forum on Social Entrepreneurship and Skoll Award for Social Entrepreneurship. Most of his initiatives are aimed at empowering the individual Social Entrepreneurs who are fuelling a new generation of Social Innovation.

Waterloo’s own Mike Lazaridis aims to transform our understanding of the universe itself by investing hundreds of millions of dollars into Perimeter Institute for Theoretical Physicsn and Institute for Quantum Computing, effectively innovating a new mechanism of education and discovery. Notable is that this area of investment is one that may well take years, possibly decades, to show what breakthroughs, if any, are discovered.

Waterloo’s own Mike Lazaridis aims to transform our understanding of the universe itself by investing hundreds of millions of dollars into Perimeter Institute for Theoretical Physicsn and Institute for Quantum Computing, effectively innovating a new mechanism of education and discovery. Notable is that this area of investment is one that may well take years, possibly decades, to show what breakthroughs, if any, are discovered.

Whether or not always attributtable to this connection with technology entrepreneurs, increasingly Social Sector organizations are starting to become much more like the entrepreneurial startups so familiar in the world of high technology. I’ve personally witnessed some of this change, and would like to suggest, that while there remain big differences, the parallels are strengthening over time. The following concepts represent just a small sampling of the key areas of similarity:

1. Founders Versus Artists

Stories are legion of smart, brash (and even mercurial) technology company founders who transform a business sector through the sheer strength of their wills. Many of these founders are “control freaks” and might find employment in conventional jobs a difficult proposition. Venture capital and angel investors have learned to be wary of such founders, citing numerous examples of founderitis – in which uncoachable founders, in a case of “my way or the highway” would rather maintain control than bend to ideas from often more experienced mentors, board members and investors.

Such personalities also exist in the Social Sector. For example, many arts organizations are founded by bright and innovative artistic directors. And yet, many of these same organizations come unravelled by the same mercurial nature that prevents the organization from being properly governed and accountable to funders (investors). With my background on both sides of this divide, the parallels are hauntingly striking.

Since such founders strengths can also be their undoing (or that of their organization), a conscious Board level assessment of such situations is always wise.

2. Running on Empty

Notwithstanding the media coverage of a few lucky technology startups such as Facebook or Google, most technology startups run of little or no significant funding. Many seek to change the world with very small amounts of capital, sometimes no more than several million dollars. The recent trend towards building such small capitalization organizations is called the Lean Startup movement. The challenges inherent in their undercapitalization is often the top complaint of such startups. However, Sergy Brin, the Google co-founder has insightfully observed that “constraints breed creativity” to describe how an underfunded state has led to the discovery of innovative ways to build companies and deliver their products.

Likewise, from my experience the vast majority of charities and nonprofits complain about being undercapitalized, and the reality is that most are. It is a fact of life in the social sector. Only now are we starting to see the emergence of social ventures, which by stealing a page from underfunded technology startups are exploring new business models and ways to deliver social change, often leveraging IT or a different process to vastly reduce costs of program delivery.

3. Technology Changes Everything

We’ve seen the emergence of a world where all information is stored in digital form and people are connected, even while mobile, the role of the web and technology can’t be underestimated. Technology-based startups, because they are small and start from scratch, often approach traditional problems in very non-traditional ways. Revenue and funding models change, as do fundamental ways to organize a business or social enterprise. Social media allows ideas to spread in a viral fashion. We have already seen how organizations like Avaaz can mobilize hundreds of thousands or even millions of supporters globally for both local and international issues of social injustices and poverty. This is a direct analogue to how many people now rely on Twitter or Facebook, rather than a printed newspaper, for much of their news and information.

4. Mission Creep – or the path forward

Technology startups have come to learn that success depends on laser sharp focus, attention to detail and execution of a “pure play” strategy (ie. only do one thing well). Thatparticular discipline has time and time again proven to be effective in a sector where technology change is moving rapidly and most startups are generally considered to be underfunded.

Likewise, Social Enterprises must adopt similar approaches to deal with underfunding and change. Even in today’s more fluid and fast-changing environment, to avoid deadly Mission Creep, Board and management must have developed a complete Theory of Change roadmap to enable Manage to Outcomes.

3 Apr 2012

0 CommentsSocial Innovation – Can Social Sector Learn from Tech Startups?

It is notable that much of the recent trend towards Social Innovation has come from people who began their careers in technology startups, in Silicon Valley or other technology clusters. Some notable examples include:

Whether or not always attributtable to this connection with technology entrepreneurs, increasingly Social Sector organizations are starting to become much more like the entrepreneurial startups so familiar in the world of high technology. I’ve personally witnessed some of this change, and would like to suggest, that while there remain big differences, the parallels are strengthening over time. The following concepts represent just a small sampling of the key areas of similarity:

1. Founders Versus Artists

Stories are legion of smart, brash (and even mercurial) technology company founders who transform a business sector through the sheer strength of their wills. Many of these founders are “control freaks” and might find employment in conventional jobs a difficult proposition. Venture capital and angel investors have learned to be wary of such founders, citing numerous examples of founderitis – in which uncoachable founders, in a case of “my way or the highway” would rather maintain control than bend to ideas from often more experienced mentors, board members and investors.

Such personalities also exist in the Social Sector. For example, many arts organizations are founded by bright and innovative artistic directors. And yet, many of these same organizations come unravelled by the same mercurial nature that prevents the organization from being properly governed and accountable to funders (investors). With my background on both sides of this divide, the parallels are hauntingly striking.

Since such founders strengths can also be their undoing (or that of their organization), a conscious Board level assessment of such situations is always wise.

2. Running on Empty

Notwithstanding the media coverage of a few lucky technology startups such as Facebook or Google, most technology startups run of little or no significant funding. Many seek to change the world with very small amounts of capital, sometimes no more than several million dollars. The recent trend towards building such small capitalization organizations is called the Lean Startup movement. The challenges inherent in their undercapitalization is often the top complaint of such startups. However, Sergy Brin, the Google co-founder has insightfully observed that “constraints breed creativity” to describe how an underfunded state has led to the discovery of innovative ways to build companies and deliver their products.

Likewise, from my experience the vast majority of charities and nonprofits complain about being undercapitalized, and the reality is that most are. It is a fact of life in the social sector. Only now are we starting to see the emergence of social ventures, which by stealing a page from underfunded technology startups are exploring new business models and ways to deliver social change, often leveraging IT or a different process to vastly reduce costs of program delivery.

3. Technology Changes Everything

We’ve seen the emergence of a world where all information is stored in digital form and people are connected, even while mobile, the role of the web and technology can’t be underestimated. Technology-based startups, because they are small and start from scratch, often approach traditional problems in very non-traditional ways. Revenue and funding models change, as do fundamental ways to organize a business or social enterprise. Social media allows ideas to spread in a viral fashion. We have already seen how organizations like Avaaz can mobilize hundreds of thousands or even millions of supporters globally for both local and international issues of social injustices and poverty. This is a direct analogue to how many people now rely on Twitter or Facebook, rather than a printed newspaper, for much of their news and information.

4. Mission Creep – or the path forward

Technology startups have come to learn that success depends on laser sharp focus, attention to detail and execution of a “pure play” strategy (ie. only do one thing well). Thatparticular discipline has time and time again proven to be effective in a sector where technology change is moving rapidly and most startups are generally considered to be underfunded.

Likewise, Social Enterprises must adopt similar approaches to deal with underfunding and change. Even in today’s more fluid and fast-changing environment, to avoid deadly Mission Creep, Board and management must have developed a complete Theory of Change roadmap to enable Manage to Outcomes.